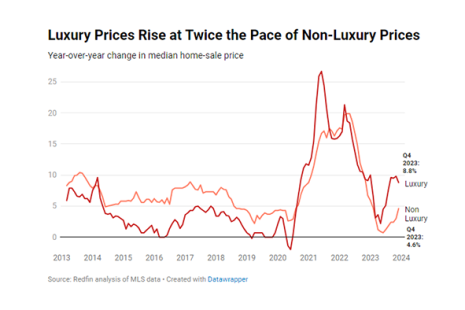

The typical U.S. luxury home sold for a record $1.17 million in the fourth quarter, up 8.8% from a year earlier, according to Redfin, Seattle.

Category: News and Trends

FHFA Releases 2024 Scorecard for Fannie Mae, Freddie Mac, CSS

The Federal Housing Finance Agency on Tuesday released the 2024 Scorecard for Fannie Mae and Freddie Mac and their joint venture, Common Securitization Solutions LLC.

DLS Servicing’s Donna Schmidt: Be Prepared for a Data Breach at Your Servicing Platform Provider

When key servicing partners like title companies are compromised, it not only hampers their direct operations, but also affects the servicers that rely on them for critical operations.

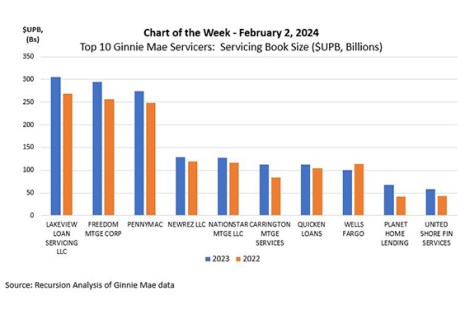

MBA Chart of the Week: Top 10 Ginnie Mae Servicers

This week’s MBA Chart of the Week highlights analysis by Recursion, a big data mortgage analytics firm, that ranks the 10 largest Ginnie servicers by servicing book size ($UPB).

Sponsored Content From ACES Quality Management: Adapting to the Changing Terrain of Mortgage Servicing

2024 brings optimism, but servicing complexities persist. Lenders must embrace tech-driven compliance and quality control measures.

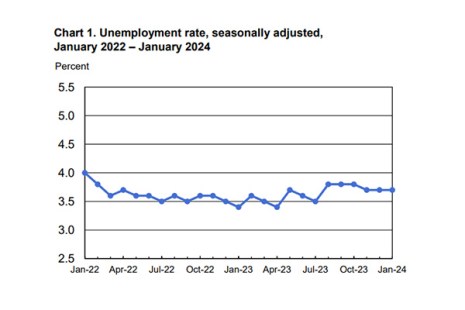

U.S. Economy Adds 353,000 Jobs in January

Total nonfarm payroll employment rose by 353,000 in January, with the unemployment rate flat at 3.7%, the Bureau of Labor Statistics reported Feb. 2.

ATTOM: Portion of Equity-Rich Homes Dips Slightly in Q4

ATTOM, Irvine, Calif., released its fourth-quarter 2023 U.S. Home Equity & Underwater Report, showing 46.1% of mortgaged residential properties in the U.S. were considered equity-rich, a slight drop from 47.4% in the third quarter.

Servicing Quote Tuesday, Feb. 6, 2024

“There are increasing signs suggesting that the extended period of prosperity in the U.S. housing market may be showing signs of easing.”

–Rob Barber, CEO for ATTOM

Servicing Quote Tuesday, Jan. 30, 2024

“The hard work continues in 2024,”

–MBA President and CEO Robert Broeksmit, CMB

MISMO Calls for Participants to Join New Workgroup on Application for Mortgage Insurance Benefits

MISMO, the real estate finance industry’s standards organization, issued a call for industry professionals to join a new development workgroup (DWG) focused on creating an enhanced replacement for the existing EDI (Electronic Data Interchange) 260 Application for Mortgage Insurance Benefits.