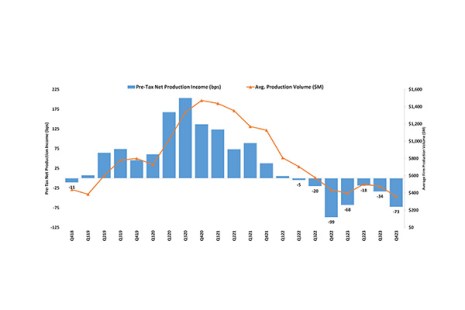

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $2,109 on each loan they originated in the fourth quarter of 2023, an increase from the reported loss of $1,015 per loan in the third quarter of 2023, according to the Mortgage Bankers Association’s newly released Quarterly Mortgage Bankers Performance Report.

Category: News and Trends

Fitch Ratings: Mortgage Insurer Ratings Reflect Strong Borrower Credit Performance

Fitch Ratings, New York, said underwriting results for U.S. mortgage insurers remained very strong through 2023.

Servicing Quote Tuesday, March 12, 2024

“For the last three years, I have fully embraced HUD’s mission to create strong, sustainable, inclusive communities and quality affordable homes for all,”

–Marcia L. Fudge, Secretary of the U.S. Department of Housing and Urban Development, on her resignation

Servicing Quote Tuesday, March 12, 2024

“For the last three years, I have fully embraced HUD’s mission to create strong, sustainable, inclusive communities and quality affordable homes for all,”

–Marcia L. Fudge, Secretary of the U.S. Department of Housing and Urban Development, on her resignation

HUD Secretary Marcia L. Fudge to Resign March 22

Marcia L. Fudge, the 18th Secretary of the U.S. Department of Housing and Urban Development, announced she will resign effective March 22, 2024.

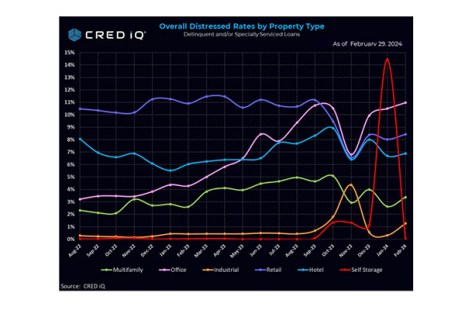

CRED iQ: Multifamily Distress Rate Up 80 Basis Points in February

CRED iQ, Wayne, Pa., reported the Distress Rate for all property types trimmed 4 basis points in February to 7.35%. However, the multifamily distress rate was up 80 basis points–the largest monthly increase in that sector in more than a year and a half.

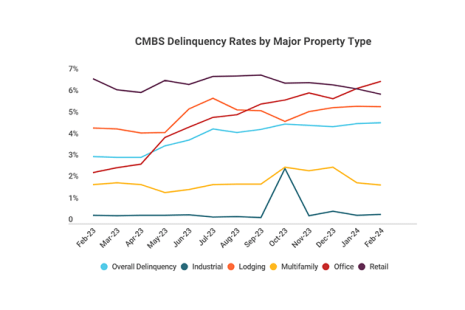

Office Sector Drives CMBS Delinquency Rate Up Slightly: Trepp

The delinquency rate for commercial mortgage-backed securities inched upward in February, according to Trepp, New York.

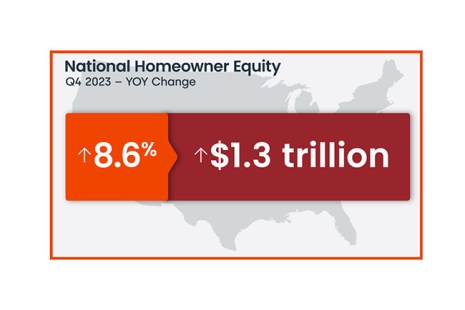

CoreLogic: Homeowner Equity Up 8.6% in Q4 2023

CoreLogic, Irvine, Calif., released its Homeowner Equity Insights report for the fourth quarter of 2023, finding homeowners with mortgages have seen their equity increase by a total of $1.3 trillion since Q4 2022. That’s a gain of 8.6% year-over-year.

Asurity’s Diane Jenkins: Hello Old Friend – Why Assumptions Are Making a Comeback

It’s no secret that mortgage lenders have seen a sharp decrease in origination volumes over the past two years. Higher interest rates coupled with a shortage in housing inventory translate into a market environment where origination volumes are likely to remain depressed for the near future.

MBA Statement on the Biden Administration’s Housing Affordability Initiatives Warns Against CFPB Reforms on Closing Costs, Title Insurance

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on the Biden administration’s announcements on housing at the State of the Union address.