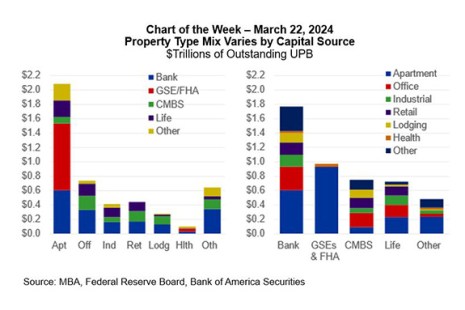

This week’s Chart of the Week shows MBA’s estimates of the distribution of CRE mortgage debt across capital sources and property types and is derived from a variety of public and private sources.

Category: News and Trends

Servicing Quote Tuesday, March 26, 2024

“We’re just not seeing that,”

–Michael Fratantoni, MBA Chief Economist and Senior Vice President of Research and Industry Technology, speaking about a spike in foreclosures and delinquencies similar to the Great Recession

Servicing Quote Tuesday, March 19, 2024

“The performance of servicing portfolios and loan workouts improved in February, as borrowers benefitted from tax refunds, the extra day in the month to submit their payments, and continued resilience in the job market,”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis.

MBA Reports Share of Mortgage Loans in Forbearance Holds Steady at 0.22% in February

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance remained unchanged at 0.22% as of Feb. 29, 2024.

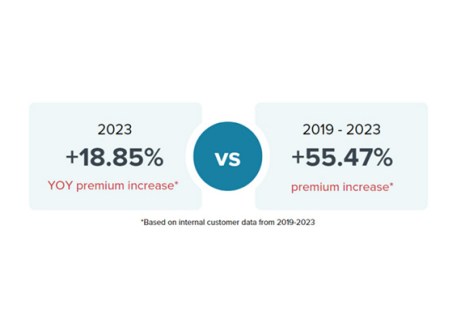

Guaranteed Rate: Home Insurance Prices Up 19% in 2023

Guaranteed Rate Insurance, Chicago, released a proprietary homeowners insurance study, finding home insurance prices increased 19% from first-half 2022 to first-half 2023 and 55% since 2019.

MBA: Commercial and Multifamily Mortgage Delinquency Rates Increased in Fourth Quarter 2023

Commercial mortgage delinquencies increased in the fourth quarter of 2023, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

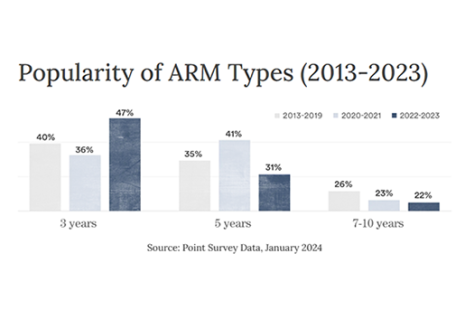

Point Survey: 70% of Homeowners With Adjustable-Rate Mortgages Regret It

More than two-thirds of homeowners who have taken out an adjustable-rate mortgage in the past 10 years regret it, according to a new study from home equity investment platform Point, Palo Alto, Calif.

MBA: Commercial and Multifamily Mortgage Debt Outstanding Increased in Fourth Quarter

The level of commercial and multifamily mortgage debt outstanding at the end of 2023 was $130 billion (2.8%) higher than at the end of 2022, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

February Foreclosure Activity Up From Last Year, ATTOM Finds

ATTOM, Irvine, Calif. reported U.S. foreclosure activity increased 8% year-over-year in February, but fell 1% from the previous month.

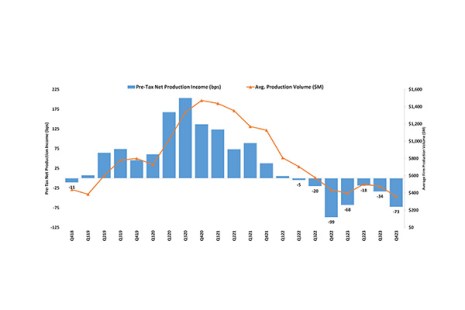

MBA: IMBs Report Net Production Losses in the Fourth Quarter of 2023

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $2,109 on each loan they originated in the fourth quarter of 2023, an increase from the reported loss of $1,015 per loan in the third quarter of 2023, according to the Mortgage Bankers Association’s newly released Quarterly Mortgage Bankers Performance Report.