The delinquency rate among KBRA-rated U.S. commercial mortgage-backed securities increased moderately in April to 4.67%, according to KBRA, New York.

Category: News and Trends

GDP Grew at 1.6% in Q1; Industry Economists Weigh In

Real gross domestic product increased at an annual rate of 1.6% in the first quarter, per the advance estimate released by the Bureau of Economic Analysis.

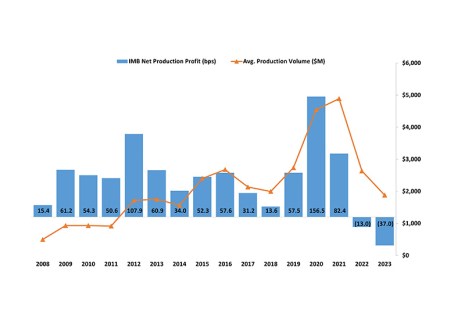

MBA: IMB Production Losses Reach Series High in 2023

Independent mortgage banks and mortgage subsidiaries of chartered banks lost an average of $1,056 on each loan they originated in 2023, down from an average loss of $301 per loan in 2023. This represents a series high in the 15-year history of the Mortgage Bankers Association’s (MBA) Annual Mortgage Bankers Performance Report.

CoreLogic: Delinquency, Foreclosure Rates Low in February

CoreLogic, Irvine, Calif., reported the overall mortgage delinquency rate was at 2.8% in February, down from 3% in February 2023.

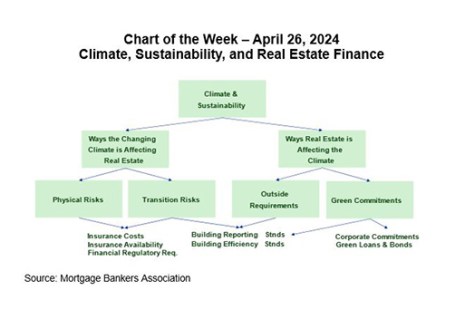

MBA Chart of the Week: Climate, Sustainability and Real Estate Finance

With Earth Day happening this month, it seems an opportune time to discuss the intersection of climate/sustainability issues and real estate finance. MBA has been leading on these issues for more than half a decade, helping members through our work related to research, policy and practice.

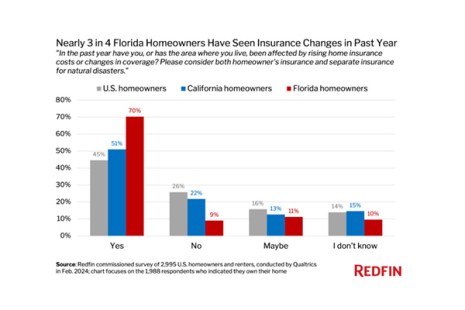

Redfin: Florida, California Homeowners See More Insurance Changes

Redfin, Seattle, recently reported 70.3% of Florida homeowners and 51% of California homeowners say they or the area they live in have been affected by rising home insurance costs or changes to coverage over the past year.

FHFA Requests Public Input on Freddie Mac Second Mortgage Proposal

The Federal Housing Finance Agency on Tuesday proposed a new product from Freddie Mac to begin purchasing certain single-family closed-end second mortgages.

Tavant’s Hassan Rashid on Unlocking Home Equity: A Strategic Move for 2024

As we make strides into 2024, American homeowners find themselves amidst an intriguing landscape of financial opportunities, particularly concerning the utilization of home equity.

MISMO Seeks Public Comment on Updated Life of Loan Process Model

MISMO, the real estate finance industry’s standards organization, announced that it is seeking comment on the latest version of the MISMO Life of Loan Process Model. The 60-day public comment period runs through June 18, 2024.

Servicing Quote Tuesday, April 23, 2024

“Homeowners living in areas where insurance premiums are surging are at risk of seeing their properties gain less value than homeowners in areas with stable premiums—and in some cases, they may even lose money,”

–Redfin Chief Economist Daryl Fairweather.