MBA is proud to recognize its Premier Members and Select Associate Members and to thank them for their continued support of MBA and the real estate finance industry.

Category: News and Trends

Homeowner Equity Dips in Q1, ATTOM Finds

ATTOM, Irvine, Calif., released its first-quarter 2024 U.S. Home Equity and Underwater report, revealing 45.8% of mortgaged residential properties in the U.S. are equity-rich.

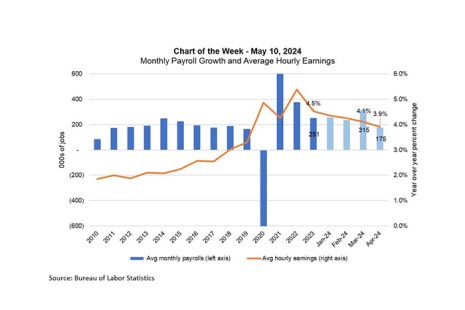

MBA Chart of the Week: Monthly Payroll Growth, Average Hourly Earnings

The Federal Open Market Committee (FOMC) left the federal funds target unchanged at its May meeting, as incoming data regarding the strength of the economy and stubbornly high inflation have resulted in a shift in the expected timing of a first rate cut.

MBA Statement on FSOC’s Report on Mortgage Servicing

MBA’s President and CEO Bob Broeksmit, CMB, released the following statement regarding the Financial Stability Oversight Council’s (FSOC) report released Friday on nonbank mortgage servicing:

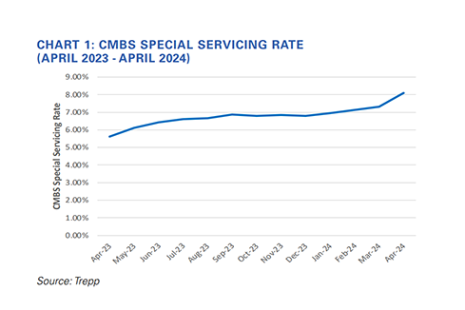

Trepp: CMBS Special Servicing Rate Jumps in April

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate “leaped” in April, rising 80 basis points to reach 8.11%.

Servicing Quote Tuesday, May 7, 2024

“Achieving these goals and setting up an effective VASP program will require all stakeholders to execute a complex loss mitigation and servicing transfer process. We are concerned with the lack of information and guidance on how to do so.”

–Mortgage Bankers Association and Housing Policy Council in a letter to the Department of Veterans Affairs regarding VASP implementation

MBA, HPC Send Letter to VA on VASP Implementation

The Mortgage Bankers Association and Housing Policy Council recently sent a letter to the Department of Veterans Affairs (VA) regarding more information and guidance about implementation of the Veterans Affairs Servicing Purchase (VASP) program.

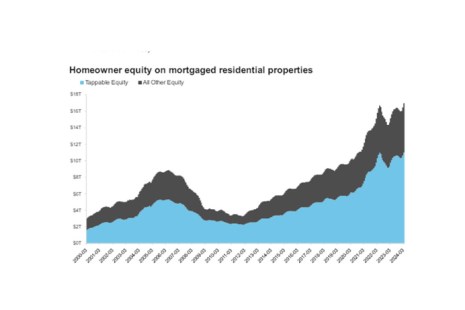

ICE Mortgage Monitor: Q1 Sees Record Levels of Tappable Equity

Intercontinental Exchange Inc., Atlanta, released its ICE Mortgage Monitor report for May, finding that homeowners with mortgages closed out the first quarter with a record $16.9 trillion in equity–$11 trillion of which was tappable.

FirstClose Survey: Many Consumers Don’t Understand Advantages of Home Equity

FirstClose, Austin, Texas, released a recent survey of homeowners, finding many lack awareness of the advantages of leveraging home equity and other related topics.

MBA Q&A with SingleSource Property Solutions’ Brian Cullen: Moving Vacant Properties to Active Housing Inventory

MBA NewsLink recently spoke to SingleSource Property Solutions’ CEO and co-founder Brian Cullen about moving vacant properties to active housing inventory.