The consumer credit market remains resilient in the face of a challenging economic environment, according to TransUnion, Chicago.

Category: News and Trends

MBA Asks FHFA to Address Outstanding Questions Before Approving Freddie Mac Second Mortgage Proposal

The Mortgage Bankers Association posed several questions to the Federal Housing Finance Agency about Freddie Mac’s proposed purchase of single-family closed-end second mortgages.

Origination Issues in Commercial Servicing: Communication Is Vital, Panel Says

NEW ORLEANS–Making sure originators and servicers are on the same page–on a variety of topics–is helpful to avoid issues down the road, panelists said during a discussion at the Mortgage Bankers Association Commercial/Multifamily Finance Servicing and Technology Conference May 21.

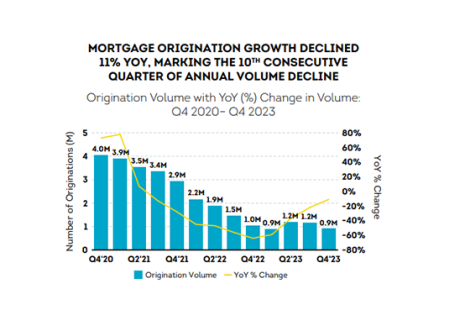

MBA: IMBs Report Net Production Losses in the First Quarter of 2024

Independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $645 on each loan they originated in the first quarter of 2024, a decrease from the reported loss of $2,109 per loan in the fourth quarter of 2023, according to the Mortgage Bankers Association’s (MBA) newly released Quarterly Mortgage Bankers Performance Report.

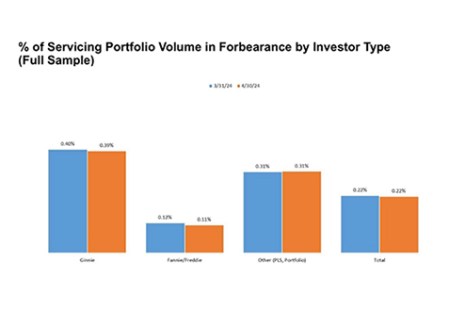

MBA: Share of Mortgage Loans in Forbearance Remains at 0.22% in April

The total number of loans now in forbearance remained unchanged at 0.22% as of April 30, 2024, the Mortgage Bankers Association’s monthly Loan Monitoring Survey reported.

Offices, Insurance Top Commercial Servicing Conversations, Panel Says

NEW ORLEANS–Looking at servicing in the current commercial market, offices and insurance issues are top of mind. That’s per a panel at the Mortgage Bankers Association Commercial/Multifamily Finance Servicing and Technology Conference, here, May 20.

Cybersecurity Panelists Talk Trends, AI, Best Practices

NEW ORLEANS–“I guarantee we’re going to scare some people. And if you’re not scared when we leave, you weren’t paying attention,” promised Brett Adams, Senior Vice President & Managing Director, Servicing, Berkadia, on a panel about guarding against cybercrime May 20.

Servicing Quote Tuesday, May 21, 2024

“The number of loans in forbearance has remained stagnant for the first four months of 2024.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

NewsLink Q&A With BSI Financial’s Larry Goldstone

MBA NewsLink interviewed BSI Financial Services’ Larry Goldstone about mortgage servicing rights values and profitability in 2024.

Clever Real Estate: 43% of New Homeowners Struggle With Payments

Clever Real Estate, St. Louis, released a new survey, with the findings that 43% of new homeowners report struggling to make on-time mortgage payments.