Imagine a widow wanting to relocate to a cozy, manageable home for her golden years. With today’s higher mortgage rates and the high cost of living, her dream can feel out of reach. But what if there was a way to make it easier?

Category: News and Trends

Navigating the Future: Lender Price’s Dawar Alimi on Technology Trends in the Mortgage Industry

In today’s rapidly evolving landscape, technology plays a pivotal role in reshaping industries, and the mortgage sector is no exception.

Servicing Quote Tuesday, June 11, 2024

“Home equity is key to mortgage holders who have seen other homeownership costs soar, including insurance, taxes and HOA fees, as a source of financial buffer.”

–Selma Hepp, CoreLogic Chief Economist

Buyers Willing to Give Up Land in Exchange for Homeownership

High mortgage rates and double-digit growth in home prices since COVID-19 are forcing home buyers to compromise on lot size and square footage to afford a house, the National Association of Home Builders reported.

ICE Mortgage Technology’s Vicki Vidal and Haris Jusic: What You Need to Know About the FHA’s Payment Supplement

During the COVID-19 pandemic, when rates remained low, the FHA streamlined its home retention loss mitigation options and provided relief for nearly 1.9 million borrowers. Despite these efforts, the current climate of high mortgage interest rates poses challenges for initiating loan modifications.

Fitch: Solid Demand, Home Price Growth Will Continue to Boost U.S. Housing Economy

The U.S. residential housing economy, which represents about 17% of GDP, will likely continue growing in second-half 2024 despite unaffordability due to high home prices and mortgage rates, according to Fitch Ratings, Chicago/New York.

Trepp Reports CMBS Delinquency Rate Dips

Trepp, New York, reported the commercial mortgage-backed securities delinquency rate dipped back below 5% in May.

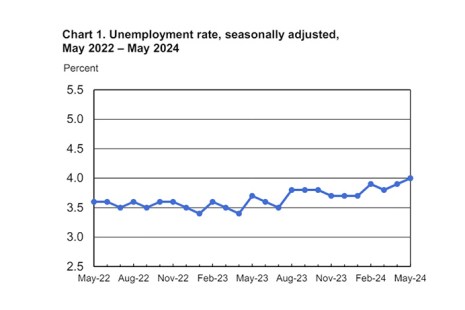

Jobs Report: 272,000 Added in May

The U.S. Bureau of Labor Statistics announced nonfarm payroll increased by 272,000 and the unemployment rate was at 4% in May.

Servicing Quote Tuesday, June 4, 2024

“Predictions of a huge spike in foreclosures after the moratorium, with the potential for a surge in zombie properties, never came true. Indeed, the opposite has happened, as abandoned homes in foreclosure continue to get harder and harder to find around the country.”

–Rob Barber, CEO for ATTOM

MBA: Commercial Mortgage Delinquency Rates Increased in First Quarter

Commercial mortgage delinquencies increased in the first quarter of 2024, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.