Mortgage Bankers Association President & CEO Bob Broeksmit, CMB, weighed in last Tuesday to set the record straight about credit reporting costs.

Category: News and Trends

GSEs Completed 52,154 Foreclosure Prevention Actions in 1Q, FHFA Finds

Fannie Mae and Freddie Mac completed more than 52,000 foreclosure prevention actions in the first quarter, bringing the total to nearly 7 million since the start of conservatorships, the Federal Housing Finance Agency reported.

Servicing Quote Tuesday, June 25, 2024

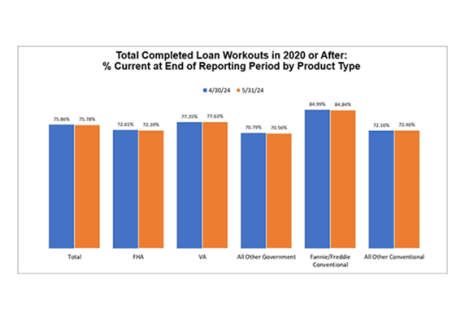

“The performance of servicing portfolios in May was solid, with about 96% of borrowers making their mortgage payments on time.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

MBA: Share of Mortgage Loans in Forbearance Decreases Slightly to 0.21% in May

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance declined slightly to 0.21% as of May 31, 2024.

Commercial and Multifamily Mortgage Debt Outstanding Increased in First Quarter: MBA

The level of commercial/multifamily mortgage debt outstanding increased by $40.1 billion (0.9%) in the first quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

Non-QM: To QC or Not to QC? Pamela Hamrick from Incenter Diligence Solutions

Late last summer, Fannie Mae’s pre-funding quality control review requirements for agency loans caught the attention of an unexpected mortgage industry segment: Non-QM/Non-Agency loan originators. MBA NewsLink asked Pamela Hamrick, President of Incenter Diligence Solutions, to explain.

Chart of the Week: Annual Cost of Servicing Performing and Non-Performing Loans

MBA’s annual Servicing Operations Study and Forum includes a deep-dive analysis and discussion of servicing costs, productivity, and portfolio characteristics for in‐house single-family servicers, representing about 60 percent of the single-family servicing market. Based on the most recent completed study cycle, fully-loaded servicing costs remained flat relative to the previous year at an average of $237 per loan. But that only tells part of the story.

Servicing Quote Tuesday, June 18, 2024

“Since the implementation of NSPIRE in October, servicers have experienced difficulties logging into the system, scheduling inspections, maintaining inspection schedules and reviewing reports.”

–MBA President and CEO Robert D. Broeksmit, CMB

MBA Urges HUD to Publish Notice About Ongoing Challenges With NSPIRE Protocol

The Mortgage Bankers Association asked HUD for assurance that servicers will not be held accountable for compliance with the new National Standards for the Physical Inspection of Real Estate (NSPIRE) system until it is “fully accessible and usable to each participant.”

Flat Branch Home Loans CEO Karen Kreutziger Powell Testifies on VA Home Lending Before Committee on Veterans’ Affairs Subcommittee

Karen Kreutziger Powell, CEO of Flat Branch Home Loans, testified Wednesday at a hearing on pending legislation before the Committee on Veterans’ Affairs Subcommittee on Economic Opportunity.