Nationwide, Columbus, Ohio, released its annual Advisor Authority study, powered by the Nationwide Retirement Institute, finding that 26% of retired investors are still paying mortgages and 25% are paying off credit card debt.

Category: News and Trends

MBA-Recommended 203(k) Program Changes Adopted by HUD

HUD released an updated set of policies for its 203(k) Rehabilitation Mortgage Insurance Program, including a number of recommendations the Mortgage Bankers Association had suggested in a Jan. 3 letter.

MBA, ABA Respond to CFPB’s Mortgage Servicing Proposal

The American Bankers Association and Mortgage Bankers Association issued a joint statement in response to the Consumer Financial Protection Bureau’s proposed rule, Streamlining Mortgage Servicing for Borrowers Experiencing Payment Difficulties; Regulation X.

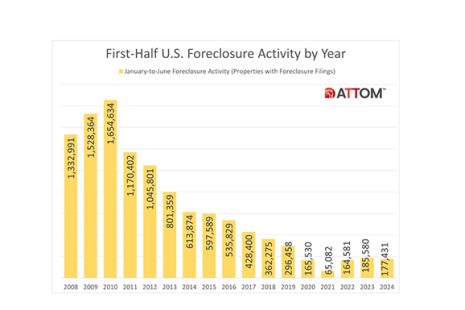

ATTOM Finds Foreclosure Activity Down From a Year Ago

ATTOM, Irvine, Calif., found 177,431 U.S. properties with foreclosure filings in the first six months of 2024, down 4.4% from first-half 2023 but up 7.8% from the same period two years ago.

Dovenmuehle’s Anna Krogh: When Unlocking the Potential of Home Equity, Understanding the Servicing Nuances is Key

Home Equity Lines of Credit (HELOCs) provide a flexible borrowing option for homeowners looking to access their home equity, offering an alternative to traditional cash-out refinances, which homeowners may be reluctant to consider if they’re currently holding a below-market interest rate on their primary mortgage.

Auction.com Finds Most Default Servicers Expect Soft Landing, Slowly Rising Foreclosures

Most default servicers expect a soft landing in the economy and a gradual increase in foreclosure volumes in the second half of 2024, according to Auction.com, Irvine, Calif.

Servicing Quote Tuesday, July 9, 2024

“Inflation data showing more reductions for the next couple of months will be the most important evidence that the Federal Reserve needs to cut rates in September.”

–MBA SVP and Chief Economist Mike Fratantoni

FHFA Releases NMDB Outstanding Residential Mortgage Statistics

There were 50.8 million outstanding mortgages with unpaid balances totaling $11.7 trillion at the end of the first quarter, the Federal Housing Finance Agency reported last week.

MISMO Publishes Revision to the IRS Form 4506-C Dataset

MISMO, the real estate finance industry’s standards organization, published an update to the previously-published IRS Form 4506-C dataset.

ServiceLink’s Miriam Moore and Eva Tapia: The Auction Effect is Becoming More Mainstream. What You Need to Know

Widespread inventory shortage has piqued the interest of mainstream buyers who are now pursuing auction properties as a means to fulfill their dream of homeownership.