Coming off a near-record low in May–and with June ending on a Sunday–the national delinquency rate increased to 3.49%, its second-highest level in 18 months, according to Intercontinental Exchange.

Category: News and Trends

MBA: Delinquency Rates for Commercial Property Loans Declined Slightly in Second Quarter of 2024

Delinquency rates for mortgages backed by commercial properties declined slightly during the second quarter of 2024. This is according to the Mortgage Bankers Association’s (MBA) latest commercial real estate finance Loan Performance Survey.

Two-Thirds of Homes Underinsured, Matic Reports

Matic, Columbus, Ohio, released its mid-year premium trends report, finding that approximately two-thirds of homes are underinsured, largely due to insurance policies that fail to reflect construction costs or home improvements.

MISMO Publishes Ability to Repay Decision Model and Notation White Paper

MISMO, the real estate finance industry’s standards organization announced the publication of The Ability to Repay Decision Model and Notation white paper.

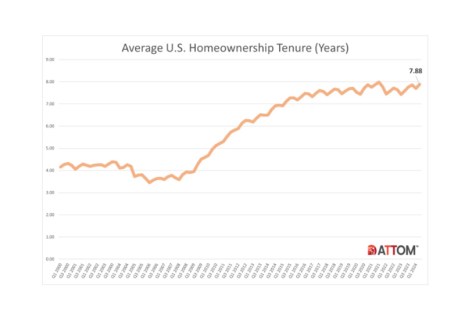

ATTOM: Home Sellers’ Profit Margins Nearly Flat in Second Quarter

ATTOM, Irvine, Calif., released its second-quarter 2024 U.S. Home Sales Report, which showed that home sellers earned a 55.8% profit margin on typical single-family home and condo sales during the second quarter.

MISMO Publishes Updated Mortgage Insurance Rate Quote Implementation Guide and Sample Files

MISMO, the real estate finance industry’s standards organization, announced the publication of updates to the Mortgage Insurance (MI) Estimated Rate Quote API Implementation Guide (iGuide) and Sample Files.

MBA Recognizes Premier, Select Members

MBA is proud to recognize its Premier and Select Members and to thank them for their continued support of MBA and the real estate finance industry.

Servicing Quote Tuesday, July 23, 2024

“The number of loans in forbearance increased in June for the first time since October of 2022.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

MISMO Calls for Participants to Join New Work Group Focusing on AVM Standardization

MISMO, the real estate finance industry’s standards organization, announced a call for industry professionals to join a new development work group that focuses on Automated Valuation Model (AVM) standardization.

Mortgage Servicers Embrace Technology to Drive Better Homeowner Experiences: Cenlar’s Shanth Ananthuni

The mortgage industry has undergone significant transformation in recent years. Consumer behavior is rapidly evolving to the ever-changing tech landscape. Because we live in a world where we are increasingly dependent on technology, as servicers, we need to strike a balance between staying competitive in the marketplace while also providing the best possible homeowner experience.