Lombardo Homes, Shelby Township, Mich., recently released a new survey finding that while 51% of non-homeowner Millennials say they are saving for a home purchase, 77% also say rent is so high it poses a challenge.

Category: News and Trends

Zombie Foreclosure Rate Hovers at Lowest Level Since 2021, ATTOM Finds

ATTOM, Irvine, Calif., released its third-quarter 2024 Vacant Property and Zombie Foreclosure Report, showing that of the residential properties currently in the process of foreclosure, just 7,007 sit vacant as “zombie foreclosures.”

Strategic Consolidation–Analyzing Mr. Cooper’s Acquisition of Flagstar’s MSR Portfolio: Vaultedge CEO Murali Tirupati

The mortgage servicing landscape has witnessed a significant shift in recent days with Mr. Cooper’s acquisition of Flagstar Bank’s mortgage servicing rights portfolio.

ICE First Look: Delinquencies Improved in July

Intercontinental Exchange, Atlanta, released its first look at July data, finding that the national delinquency rate fell 12 basis points from June to 3.37% in July.

MBA Economist Mike Fratantoni on Jerome Powell’s Remarks Indicating Cuts

Federal Reserve Chair Jerome Powell spoke Aug. 23 at an economic symposium sponsored by the Federal Reserve Bank of Kansas City, in Jackson Hole, Wyo. His remarks implied the likelihood of near-term rate cuts.

MBA’s Chart of the Week: Pre-Tax Net Production Income and Production Volume

Independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks reported a pre-tax net profit of 17 basis points, or $693 on each loan they originated in the second quarter of 2024, an increase from the reported loss of 25 basis points, or $645 per loan in the first quarter of 2024, according to the Mortgage Bankers Association’s (MBA) newly released Quarterly Mortgage Bankers Performance Report.

Servicing Quote Tuesday, Aug. 20, 2024

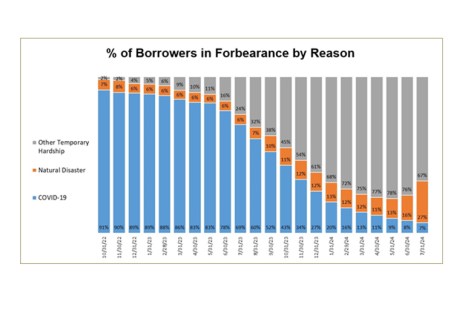

“July saw an increase of approximately 20,000 more U.S. homeowners in forbearance compared to the previous month.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

Incenter’s Alison Tulio and Craig Eagleson on Softening the Impact of Spiking Escrows

High valuations and interest rates are not the only factors that have negatively impacted the mortgage industry. Added to these major hurdles, spiking escrows due to rising property tax assessments and homeowners insurance costs are pushing some borrowers to the brink of default.

MBA Reports Share of Mortgage Loans in Forbearance Increases to 0.27% in July

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.27% as of July 31, 2024. According to MBA’s estimate, 135,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.2 million borrowers since March 2020.

ATTOM Reports Foreclosures See Monthly, Annual Increase in July

ATTOM, Irvine, Calif., released its July 2024 U.S. Foreclosure Market Report, noting that foreclosure filings rose 15% month-over-month and a slight .2% year-over-year.