MBA’s President and CEO, Bob Broeksmit, CMB, issued a statement following Federal Reserve Vice Chair Michael Barr’s speech outlining recommendations to re-propose the Basel III Endgame proposal.

Category: News and Trends

Mortgage Cadence’s Melissa Kozicki–How Compliance Enables Innovation and Optimization

In today’s fiercely competitive mortgage environment, dynamic risk management through an opportunistic compliance lens is a competitive advantage.

CMBS Special Servicing Rate Leaps in August, Trepp Finds

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate jumped in August, climbing 16 basis points to 8.46%.

Mphasis: Prospective Home Buyers Worry About Costs, Insurance

Mphasis Digital Risk, Maitland Fla., conducted a study finding that prospective home buyers say home insurance affordability is a major factor in where they decide to move.

ATTOM: Foreclosure Activity Down in August

ATTOM, Irvine, Calif., released its August 2024 U.S. Foreclosure Market Report, revealing a total of 30,227 U.S. properties with foreclosure filings–down 5.3% from July and down 11% year-over-year.

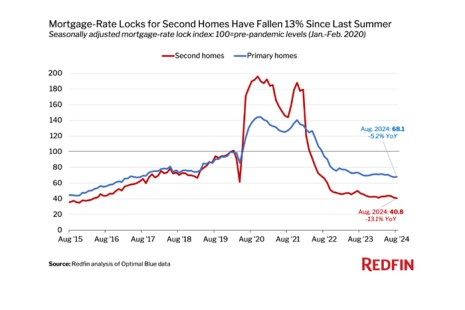

Redfin: Demand for Second-Home Mortgages Lowest Since 2016

Redfin, Seattle, reported mortgage rate locks for second homes fell 13.1% year-over-year in August, to hit the lowest level since March 2016 on a seasonally adjusted basis.

Commercial Mortgage Delinquency Rates Increased in the Second Quarter of 2024

Commercial mortgage delinquencies increased in the second quarter of 2024, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report.

Servicing Quote Tuesday, Sept. 10, 2024

“As policymakers and elected officials consider options, MBA is leaving no stone unturned to maximize the potential of existing programs that can help narrow the gap between supply and demand. For example, we have been instrumental in bringing about a needed update and expansion of the FHA 203(k) loan program, which enables homebuyers to finance the cost of a home purchase and simultaneous renovation of that home with funds borrowed based on the after-renovation (i.e., future) value of the house.”

–MBA President & CEO Bob Broeksmit, CMB

ATTOM IDs Areas With Highest Concentration of ‘At-Risk’ Markets

ATTOM, Irvine, Calif., released a Special Housing Risk Report, highlighting that California, New Jersey/New York and Illinois are the areas with the most at-risk housing markets in the country, meaning they are more vulnerable to declines based on home affordability, underwater mortgages and other metrics.

To the Point With Bob–Amid Grand Visions, MBA is Tackling Housing Shortage One Program at a Time

The lack of affordable housing is a big issue this election year, writes MBA President and CEO Bob Broeksmit, CMB.