The Mortgage Bankers Association announced that Astrid Vermeer joined the association as Senior Vice President, Chief Financial Officer. Vermeer will oversee MBA’s managerial accounting and financial operations, including financial reporting, budgeting, forecasting, and risk management.

Category: News and Trends

ICE First Look: Delinquency Rate Ticks Up in September

Intercontinental Exchange Inc., Atlanta, reported the national delinquency rate rose 14 basis points in September to 3.48%, up 4.3% from August and up 5.7% from September 2023.

Forgoing Automation is Literally Setting Servicers Up for Disaster–Clarifire CEO Jane Mason

This year’s storm season is testing everyone’s capacity to be responsive in the face of the unexpected. I know firsthand, as most of our team lives in Pinellas County, Fla., which was recently hit by multiple deadly storms.

Auction.com: Demand for Auction Properties Continues to Fall in Q3

Auction.com, Irvine, Calif., released its Auction Market Dispatch for the third quarter, finding that demand continues to weaken.

MBA White Paper: Reforms Needed to RESPA Section 8 to Better Serve Consumers, Mortgage Market

Comprehensive reforms are necessary to modernize Section 8 of the Real Estate Settlement Procedures Act (RESPA) to better serve consumers and the real estate finance industry in today’s highly-regulated mortgage market. That is according to a new white paper from the Mortgage Bankers Association.

Commercial, Multifamily Mortgage Delinquency Rates Increase in Third Quarter

Delinquency rates for mortgages backed by commercial properties increased slightly during the third quarter of 2024.

Servicing Quote of the Week

“The percentage of loans in forbearance increased for the fourth consecutive month.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

Share of Mortgage Loans in Forbearance Increases to 0.34% in September

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.34% as of Sept. 30, 2024.

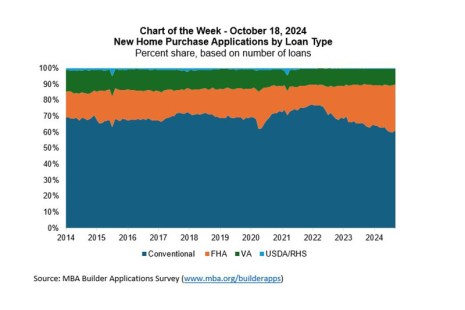

MBA Chart of the Week: New Home Purchase Applications by Loan Type

Mortgage applications to buy newly built homes have been seeing year-over-year growth since 2023, and in the MBA Builder Applications Survey results for September 2024, purchase applications were up 11% on an annual basis.

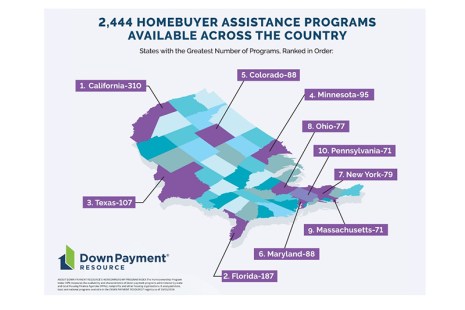

DPR: 29 Homebuyer Assistance Programs Added in Q3

Down Payment Resource, Atlanta, released its Q3 Homeownership Program Index Report, highlighting the homebuyer assistance programs added and available in the quarter. The number offered reached 2,444 in Q3.