MBA’s President and CEO Bob Broeksmit, CMB, issued a statement regarding the Federal Housing Administration’s release of its annual report to Congress.

Category: News and Trends

Servicing Quote of the Week

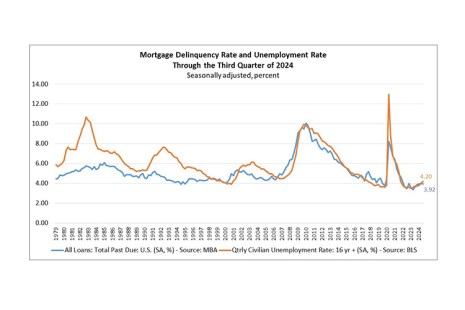

“Mortgage delinquencies have inched up over the past year. Even though there was a small, third-quarter decline in the overall delinquency rate compared to the previous quarter, this was driven by a decrease in 30-day delinquencies.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

MBA: Mortgage Delinquencies Decrease Slightly in the Third Quarter of 2024, Up on Annual Basis

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased slightly to a seasonally adjusted rate of 3.92% of all loans outstanding at the end of the third quarter of 2024 compared to one year ago, according to the Mortgage Bankers Association’s National Delinquency Survey.

MBA RIHA Report: Housing Supply Will Remain Tight as Older Americans Continue to ‘Age in Place’

As older Americans continue to remain living in their homes for longer, and the homeownership rate for Americans over 50 continues to increase, there will be excess demand for older Americans’ homes over the next decade as shifting demographics impact housing for homebuyers of all ages.

ICE: Record Levels of Tappable Equity in Q3

Intercontinental Exchange Inc., Atlanta, reported that mortgage holders at the end of the third quarter held $17.2 trillion in equity. Of that, $11.2 trillion was deemed tappable–meaning it can be borrowed against with the homeowner still maintaining a 20% equity stake.

CardRates: Many Young Americans Spending Significantly on Housing

CardRates, Gainesville, Fla., released a survey of millennial and Gen Z Americans, finding 76.32% of respondents are spending more than 31% of their monthly income on housing.

NewsLink Q&A: Dax Junker, CEO of Title Clearing & Escrow

MBA NewsLink recently interviewed Dax Junker of Title Clearing & Escrow about the title insurance industry.

Mortgage Servicing: Getting Reg X Reform Right is a Top Priority for 2025

Preventing foreclosures requires active collaboration between servicers and homeowners.

Servicing Quote of the Week

“The near-total disappearance of zombie foreclosures has been and still is one of the more subtle, but important benefits of the country’s soaring housing market.”

–Rob Barber, CEO for ATTOM

Freddie Mac’s Mike Hutchins Announces LPA Update; Talks Tech, Repurchases With Fannie Mae’s Priscilla Almodovar

DENVER–Freddie Mac President Mike Hutchins announced Oct. 28 the latest addition to the enterprise’s automated underwriting system (Loan Product Advisor): LPA Choice.