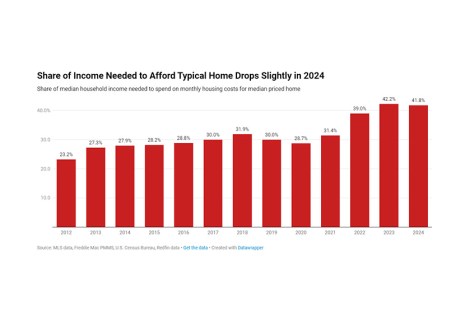

Redfin, Seattle, released an analysis of 2024 affordability trends, finding that there was a slight improvement in housing affordability, although it was still the second-least-affordable year on record.

Category: News and Trends

Servicing Quote of the Week

“MBA believes strongly that any efforts to remove Fannie Mae and Freddie Mac (the GSEs) from their federal government conservatorships must fully consider the impact on single-family and multifamily housing markets and overall financial stability. This includes the critical move that Congress establishes an explicit federal backstop for mortgage-backed securities.”

–MBA’s President and CEO Bob Broeksmit, CMB

Neptune Flood: 20M Homes at Flood Risk, but Only 3.8M Insured

Neptune Flood, St. Petersburg, Fla., released an analysis of the U.S. residential flood insurance market, finding that while 20 million U.S. homes are at moderate-to-severe flood risk, only 3.8 million are insured.

MBA Names Jamie Woodwell SVP of Commercial/Multifamily Policy and Strategic Industry Engagement

The Mortgage Bankers Association on Monday promoted Jamie Woodwell to Senior Vice President of Commercial/Multifamily Policy and Strategic Industry Engagement. Woodwell, a 20-year veteran at MBA, will oversee the association’s public policy and member engagement efforts across all commercial real estate finance sectors, working closely with member leaders and staff to advance MBA members’ business and policy objectives.

CoreLogic: Investor Share Likely to Remain Roughly Quarter of Total Sales

CoreLogic, Irvine, Calif., released its report on Q3 2024 investor activity on home purchases, finding a small uptick from mid-year numbers.

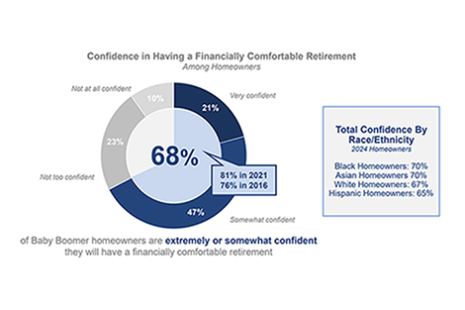

Freddie Mac Finds Boomers Hold $17 Trillion of Country’s Total Home Equity

Three-quarters of homeowners born before 1964 are likely to leave much of their $17 trillion in home equity to their children, according to Freddie Mac’s latest analysis of Baby Boomers’ housing perceptions, preferences and plans.

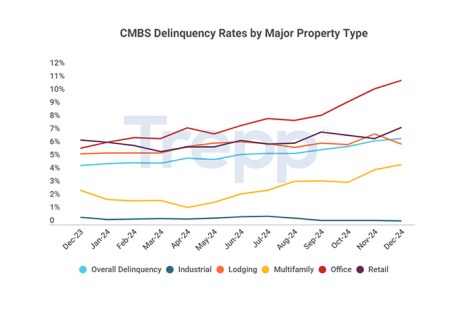

Trepp Reports CMBS Delinquency Rate Rises Again in December

Trepp, New York, reported its CMBS delinquency rate rose in December, with the overall rate up 17 basis points to 6.57%.

MBA Statement on FHFA and Treasury Amendments to the Preferred Stock Purchase Agreements

MBA’s President and CEO Bob Broeksmit, CMB, issued a statement on the Jan. 2 Federal Housing Finance Agency (FHFA) and U.S. Treasury amendments to the Preferred Stock Purchase Agreements (PSPAs).

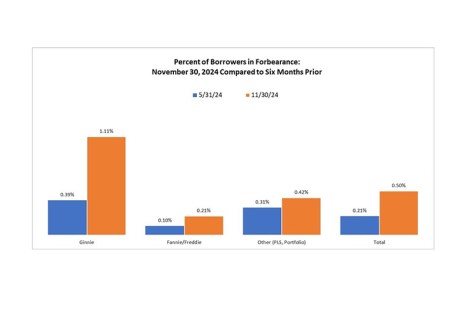

Share of Mortgage Loans in Forbearance Increases to 0.50% in November, MBA Reports

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.50% as of Nov. 30, 2024. According to MBA’s estimate, 250,000 homeowners are in forbearance plans.

Servicing Quote of the Week

“Our recommendations demonstrate strong support for HUD’s draft and alignment on

significant points related to the loss mitigation process.”

–MBA and other groups in a letter to FHA on loss mitigation update recommendations