“The overall mortgage forbearance rate decreased slightly in December as some borrowers got back on track following last fall’s severe weather in the Southeast.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis.

“The overall mortgage forbearance rate decreased slightly in December as some borrowers got back on track following last fall’s severe weather in the Southeast.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis.

MBANow recently sat down with some mortgage industry leaders to hear about their experience with the Certified Mortgage Banker designation.

Deephaven Mortgage’s Sara Stogsdill has been busy since Hurricanes Helene and Milton struck the Southeastern U.S. MBA NewsLink interviewed her about the pivotal role of operations teams in minimizing the financial consequences of these major events.

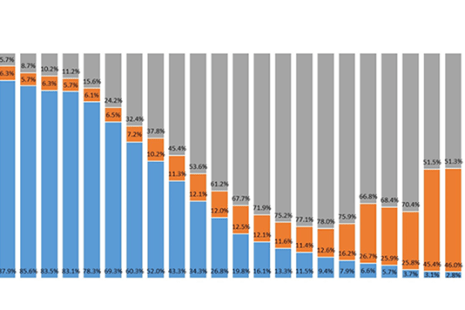

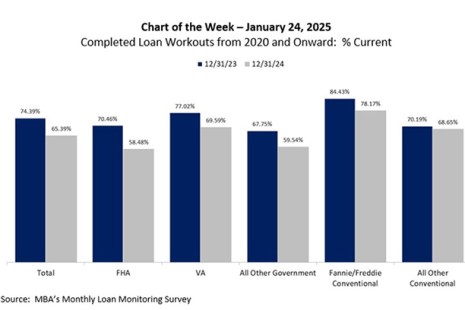

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance decreased by 3 basis points from 0.50% of servicers’ portfolio volume in the prior month to 0.47% as of Dec. 31, 2024. According to MBA’s estimate, 235,000 homeowners are in forbearance plans.

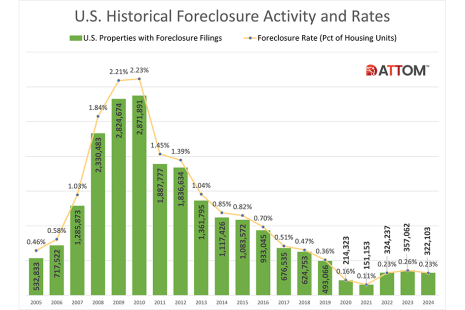

ATTOM, Irvine, Calif., reported foreclosure filings–default notices, scheduled auctions and bank repossessions–were reported on 322,103 U.S. properties in 2024, down 10% from 2023 and down 35% from 2019, before the pandemic shook up the market.

The MBA Opens Doors Foundation launched the MBA Opens Doors Disaster Relief Program, which will provide an additional $100,000 to Children’s Hospital Los Angeles to support the children and families impacted by the Southern California wildfires.

According to the latest results from MBA’s Monthly Loan Monitoring Survey, approximately 235,000 homeowners are in forbearance plans as of December 31, 2024. This level is substantially lower than the peak of almost 4.3 million homeowners in June 2020 and the 8.5 million borrowers who have been provided forbearance since March 2020.

In light of President Trump’s “Regulatory Freeze Pending Review” executive order issued last week, the Mortgage Bankers Association asked the CFPB to postpone for 60 days the effective compliance dates for entities subject to its Nonbank Registration Regulation issued on June 3, 2024.

“Mortgage servicers have provided forbearance to approximately 8.5 million borrowers since March 2020, performing diligently to implement new forbearance and home retention programs from FHA and other federal agencies. We appreciate FHA’s efforts to streamline the loss mitigation process.”

–MBA’s President and CEO Bob Broeksmit, CMB, discussing the FHA’s release of its permanent loss mitigation waterfall

MBA’s President and CEO Bob Broeksmit, CMB, issued the following statement on Bill Pulte being nominated to be Director of the Federal Housing Finance Agency.