Home prices ended the year on an up note, but 2024 was the softest year for home price growth in more than a decade, according to Intercontinental Exchange.

Category: News and Trends

Servicing Panel Talks AI, Insurance, Future Trends

DALLAS–What’s next for the servicing industry when it comes to trends and challenges in technology, regulation and the overall market?

MBA: Mortgage Delinquencies Increase in Fourth-Quarter 2024

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.98% of all loans outstanding at the end of the fourth quarter of 2024, according to the Mortgage Bankers Association’s National Delinquency Survey.

What’s Next in Washington? Industry Leaders Weigh In

DALLAS–“From HUD to CFPB to the chairs of key committees on Capitol Hill, MBA is bracing for big change,” said Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, in a session on post-election analysis at MBA’s 2025 Servicing Solutions Conference & Expo.

143,000 Jobs Added in January, Unemployment Rate Edges Down

There were 143,000 jobs added to total nonfarm payroll employment in January, the Bureau of Labor Statistics reported Feb. 7.

MBA Leads Industry Response to Trust Licensing Issues in Maryland

On Friday, an MBA-led coalition of industry trade groups including the Maryland Mortgage Bankers and Brokers Association submitted a comment letter to the Maryland Office of Financial Regulation to respond to OFR’s guidance and emergency regulations to facilitate compliance with the state Appellate Court’s April 2024 ruling in the case of the Estate of Brown v. Ward.

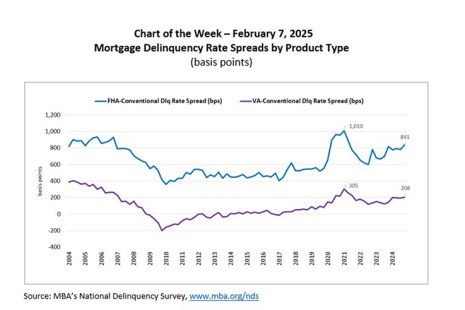

Chart of the Week: Mortgage Delinquency Rate Spreads by Product Type

According to the latest results from MBA’s National Delinquency Survey (NDS), the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to a seasonally adjusted rate of 3.98 percent of all loans outstanding at the end of the fourth quarter of 2024.

Servicing Quote of the Week

“At MBA, we envision a new era in our relationship with Fannie and Freddie. We welcome the strengthening of our partnership. Lenders of all types and sizes and servicing firms can and should be partners with the GSEs to sustain a housing finance system that is stable, liquid, enables homeownership and the creation of generational wealth.”

–MBA President and CEO Bob Broeksmit, CMB, discussing talk around ending the GSEs’ conservatorship at the Independent Mortgage Bankers conference

FOMC Holds Rates Steady; MBA Economist Weighs In

The Federal Reserve’s Federal Open Market Committee left interest rates unchanged Jan. 29.

Broeksmit: Big Challenges, Big Opportunities

AUSTIN–The last few years have seen big challenges for mortgage bankers: COVID, market disruptions, inflation, and high interest rates to name a few. But there are many opportunities for mortgage bankers to be part of something that will benefit our industry and our customers, according to MBA President and CEO Bob Broeksmit, CMB.