Optimal Blue, Plano, Texas, recorded a 7% month-over-month increase in mortgage lock volume in February, largely driven by strong refinance activity.

Category: News and Trends

Servicing Quote of the Week

“While it’s no surprise that insurance costs are rising, we’re beginning to see emerging trends in terms of how homeowners are responding to the higher cost environment.”

–Andy Walden, Head of Mortgage and Housing Market Research for Intercontinental Exchange

Trepp: CMBS Delinquency Rate Decreases in February

Trepp, New York, found the CMBS Delinquency Rate fell in February, with the overall rate decreasing 26 basis points to 6.3%.

VantageScore CreditGauge: Mortgages Help Drive Credit Balance Increases in January

VantageScore, San Francisco, released its CreditGauge report for January, finding average overall credit account balances rose by more than $1,000 from December 2024.

Tavant’s Sandeep Shivam: How Gen AI-Powered Coaching Revolutionizes Mortgage Servicing

As a result of the increasing costs and negative customer experiences reported, mortgage servicing companies are seeking technology solutions that leverage artificial intelligence to more effectively answer customer questions and resolve incoming customer inquiries.

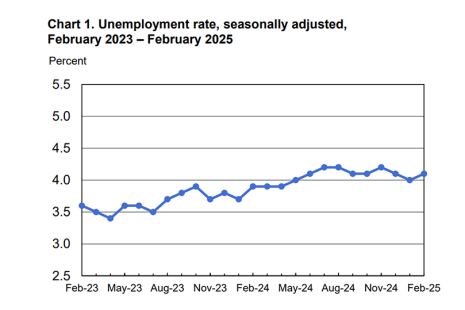

Jobs Up by 151,000 in February; Unemployment Rate Ticks Up

The Bureau of Labor Statistics released February employment numbers, finding total nonfarm payroll rose by 151,000 in February.

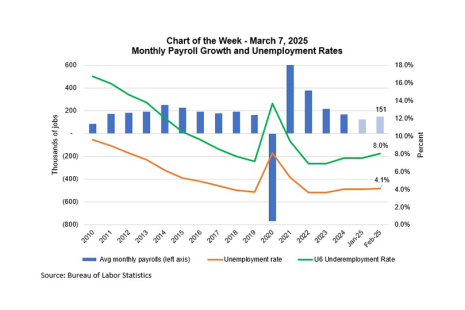

MBA Chart of the Week: Monthly Payroll Growth, Unemployment Rates

The job market softened somewhat in February, with the unemployment rate increasing to 4.1%, the pace of private sector job growth up by 140,000, and wage growth steady at 4%.

Servicing Quote of the Week

“National-level delinquency rates for December show a mortgage market with strong performance, with 97% of borrowers making on-time payments. The rate is unchanged from a year earlier and a bit better than a month earlier.”

–Molly Boesel, Principal Economist for CoreLogic.

TransUnion Predicts Increase in Mortgage Originations This Year

TransUnion, Chicago, released its Q4 2024 Quarterly Credit Industry Insights Report, predicting multiple credit products will see growth this year.

ATTOM: Refinance Activity Up in Q4 Amid Continued Challenges

ATTOM, Irvine, Calif., released its fourth-quarter 2024 U.S. Residential Property Mortgage Origination Report, showing that 1.64 million mortgages secured by residential property were issued in the United States during Q4.