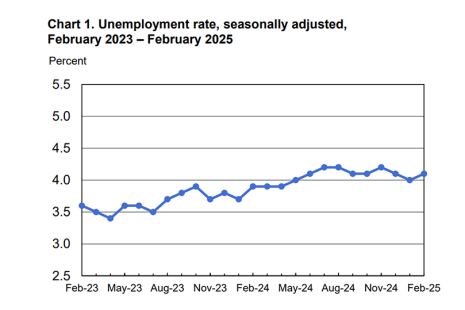

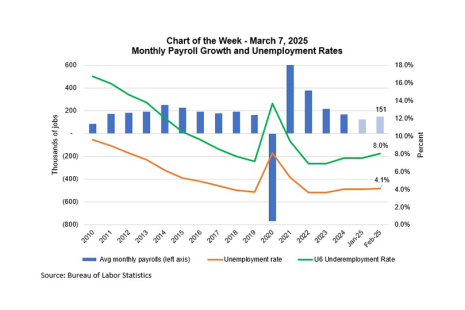

The Bureau of Labor Statistics released February employment numbers, finding total nonfarm payroll rose by 151,000 in February.

Category: News and Trends

MBA Chart of the Week: Monthly Payroll Growth, Unemployment Rates

The job market softened somewhat in February, with the unemployment rate increasing to 4.1%, the pace of private sector job growth up by 140,000, and wage growth steady at 4%.

Servicing Quote of the Week

“National-level delinquency rates for December show a mortgage market with strong performance, with 97% of borrowers making on-time payments. The rate is unchanged from a year earlier and a bit better than a month earlier.”

–Molly Boesel, Principal Economist for CoreLogic.

TransUnion Predicts Increase in Mortgage Originations This Year

TransUnion, Chicago, released its Q4 2024 Quarterly Credit Industry Insights Report, predicting multiple credit products will see growth this year.

ATTOM: Refinance Activity Up in Q4 Amid Continued Challenges

ATTOM, Irvine, Calif., released its fourth-quarter 2024 U.S. Residential Property Mortgage Origination Report, showing that 1.64 million mortgages secured by residential property were issued in the United States during Q4.

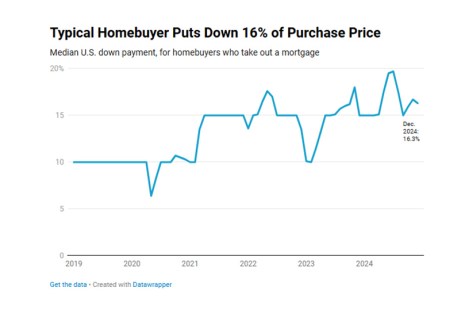

Redfin: Typical Buyer Putting Up 16.3% Down Payment

Redfin, Seattle, reported that the typical U.S. homebuyer’s down payment in December was 16.3% of the purchase price, up from 15% a year earlier.

CoreLogic: U.S. Overall Delinquency Rate at 3.1% in December

CoreLogic, Irvine, Calif., reported that the U.S. overall delinquency rate was flat year-over-year, but dropped slightly from November.

Servicing Quote of the Week

“While the number of forbearance requests grew in January, the number of forbearance exits outweighed that pick-up, reaching the highest level since June 2022.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

Redfin: Combined Value of U.S. Homes Climbed to $49.7 Trillion

Redfin, Seattle, reported the combined value of U.S. homes increased $2.5 trillion in 2024 to hit $49.7 trillion.

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.40% in January

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 7 basis points from 0.47% of servicers’ portfolio volume in the prior month to 0.40% as of January 31, 2025. According to MBA’s estimate, 200,000 homeowners are in forbearance plans.