ValuePenguin, a division of LendingTree, Charlotte, N.C., released a new survey finding that two in three home insurance policyholders say their rates rose in 2024.

Category: News and Trends

Auction.com: Foreclosure Auction Volume Hits Six-Quarter High in Q1

Auction.com, Irvine, Calif., found foreclosure auction volume was up 4% annually in the first quarter, to notch a six-quarter high.

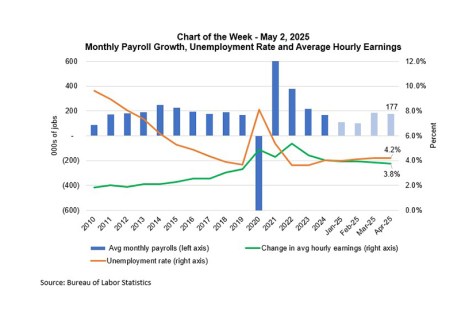

Chart of the Week: Monthly Payroll Growth, Unemployment Rate and Average Hourly Earnings

The April Employment Situation report showed that the job market continues to hold up.

VantageScore: Credit Scores Recover Overall, but Mortgage Delinquencies Grow

VantageScore, San Francisco, released its CreditGauge for March, finding that the average VantageScore 4.0 credit score returned to 702 after dipping slightly in February.

Recruiting Underway: President of MISMO, the Mortgage Industry’s Standards Development Organization

Are you a visionary leader passionate about driving transformative change? Do you thrive on shaping industries through innovation and collaboration?

U.S. Adds 177,000 Jobs in April; Industry Economists Weigh In

The U.S. Bureau of Labor Statistics reported that 177,000 jobs were added to total nonfarm payroll employment last month, with the unemployment rate flat at 4.2%.

Servicing Quote of the Week

“While rising home values can influence property taxes, they don’t automatically lead to higher bills for homeowners. In many areas, we’ve seen taxes increase not just due to property appreciation, but also because of growing costs to operate local governments and schools or shifts in how tax burdens are distributed.”

–Rob Barber, CEO at ATTOM

Milliman: Fourth-Quarter Mortgage Default Risk Decreases

Milliman, Seattle, found a slight decrease in the lifetime serious delinquency rate (for homes 180 days or more delinquent) for U.S.-backed mortgages.

RCN Capital: Real Estate Investor Sentiment Falls

RCN Capital, South Windsor, Conn., released the spring 2025 RCN Capital/CJ Patrick Co. Investor Sentiment Index, finding that the quarterly score fell to 88.

MBA Premier Member Editorial: Is the Rocket-Mr. Cooper Deal A Catalyst for Change in Mortgage Servicing?

The recent announcement of Rocket’s acquisition of Mr. Cooper has sent ripples across the mortgage industry, creating what many industry leaders are calling a watershed moment for mortgage technology. This consolidation represents more than just another M&A deal–it marks the beginning of a fundamental shift in how the market’s largest players view servicing portfolios and technology infrastructure.