HOLLYWOOD, FLA.–Keeping ahead of fraudulent activity is essentially a full-time function for mortgage servicers, panelists said here at MBA’s Commercial/Multifamily Finance Servicing and Technology Conference.

Category: News and Trends

Bill Pulte on What’s Next for Federal Housing, Conservatorship and Transparency

NEW YORK–“I think federal housing has been underrepresented,” said Federal Housing Finance Agency Director Bill Pulte. “I think this room has been underrepresented historically at the federal level.”

MBA’s Bob Broeksmit Shares Optimistic Outlook for Mortgage Industry

NEW YORK–Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, shared his views on the industry from the main stage at MBA’s Secondary and Capital Markets Conference, offering a largely positive outlook.

Nearly Half of Homeowners Have Some Regret About Purchasing Their Home

Nearly half of current homeowners–45%–report having at least one regret about the purchase of their current home, according to a new survey from Bankrate, New York.

MBA Statement on the Passage of the House Reconciliation Bill

MBA President and CEO Bob Broeksmit, CMB, released a statement on the passage of the Republican-led tax and spending package in the U.S. House of Representatives.

Panelists Outline Challenges to Releasing GSEs, Possibility of Guarantee

NEW YORK–“In any market system where you have some lack of clarity, there’s a price to that,” said Scott Ulm, CEO and Vice Chairman of ARMOUR Residential Reit Inc. “Undoubtedly, the more ambiguity you put into it, the higher the price gets.”

N.Y. Fed President John Williams Offers Economic Outlook

NEW YORK–John Williams, President and CEO of the Federal Reserve Bank of New York, offered an optimistic but measured view of the U.S. economy during a session at the Mortgage Bankers Association’s Secondary and Capital Markets Conference.

Servicing Quote of the Week

“There were mixed results for mortgage performance in the first quarter of 2025 compared to the end of 2024. Delinquencies on conventional loans increased slightly, while mortgage delinquencies on FHA and VA loans declined.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

MBA Chair Laura Escobar: During These Times, ‘MBA Is Hardly a Bystander’

NEW YORK–Mortgage Bankers Association Chair Laura Escobar, President of Lennar Mortgage, took to the stage during MBA’s Secondary and Capital Markets Conference, highlighting what a difference just a year makes in the political and economic environment.

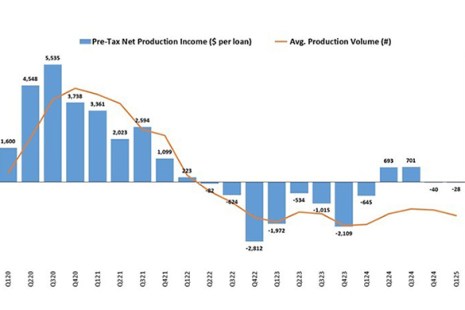

IMBs Report Slight Production Losses in First Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $28 on each loan they originated in the first quarter, compared to a net loss of $40 per loan in the fourth quarter of 2024, according to MBA’s newly released Quarterly Mortgage Bankers Performance Report.