Black Knight, Jacksonville, Fla., said nearly 1% of first quarter originations became delinquent six months post-origination. Though this represented less than one-third of the 2000-2005 delinquency average of 2.93%, it is up more than 60% over the past 24 months and the highest since 2010.

Category: News and Trends

Homeowners Today Staying in Homes Five Years Longer Than in 2010

Redfin, Seattle, said the typical American homeowner has spent 13 years in their home, up from eight years in 2010. Median home tenure increased in all 55 metros Redfin analyzed, leading to decreased inventory available for first-time home buyers in many places.

Joe Ludlow of Advantage Systems on the Long Road to Embracing Technology

Joe Ludlow is Vice President for Irvine, Calif-based Advantage Systems, a provider of accounting and financial management tools for the mortgage industry.

Commercial Servicing Software Must be Flexible

Commercial servicing software needs to be flexible and scalable. It must accommodate a variety of loan products; include commercial-specific reporting, payment and escrow administration functionality; and provide support for asset managers.

SEC to Examine Disclosure Requirements for RMBS

Securities and Exchange Commission Jay Clayton last week issued a statement instructing SEC staff to review the Commission’s residential mortgage-backed securities asset-level disclosure requirements with an eye toward facilitating more SEC-registered offerings.

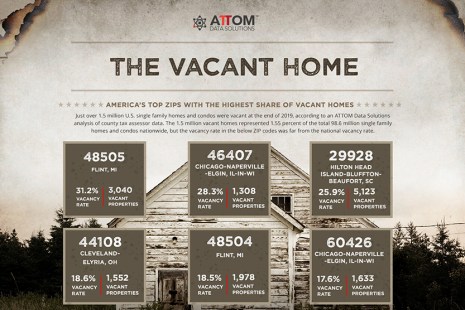

‘Zombie’ Properties Fall Below 3%

ATTOM Data Solutions, Irvine, Calif., said 1.527 million U.S. single-family homes and condos were vacant in the fourth quarter, representing 1.5 percent of all U.S. homes.

Steve Ozonian of Williston Financial Group on Fraud and Security

Steve Ozonian is President and CEO of Williston Financial Group, Portland, Ore. Over the course of his career, he has engineered growth of multiple real estate related businesses.

Survey: Buyers, Sellers Say Rising Home Prices Have ‘Made Their Lives Worse,’ Want Policy Changes

Home buyers and sellers are nearly twice as likely to support policies designed to keep homes affordable as they are to support policies designed to strengthen home values, according to a new report from Redfin, Seattle.

HUD, Justice Department Reach Agreement on False Claims Act Violations

AUSTIN, TEXAS–HUD and the Department of Justice yesterday signed a memorandum of understanding outlining “prudent” guidance for False Claims Act violations, a move that analysts said could help eliminate uncertainty in FHA lending and provide incentives for private market lending in government lending programs.

MBA Releases New White Paper: The Basic Components of an Information Security Program

The Mortgage Bankers Association released a new white paper, The Basic Components of an Information Security Program, which provides an overview of current information security risks that affect the mortgage industry, as well as explanations of basic components of an information security program intended to help manage those risks.