In the wake of the U.S. military drone strike against the leader of Iran’s special operations forces last week, the Department of Homeland Security, as well as the New York Department of Financial Services, issued warnings about potential Iranian cybersecurity threats targeting U.S. businesses, particularly financial institutions.

Category: News and Trends

Housing Markets that Changed Most over Past 10 Years

According to Redfin, Seattle, the U.S. housing market ended the decade in a “vastly different place” than it began.

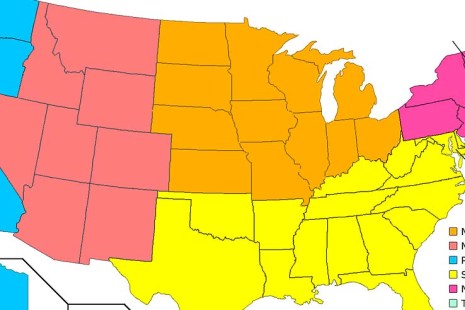

U.S. Population Growth Continues to Slow

Data released by the U.S. Census Bureau shows 42 states and the District of Columbia had fewer births in 2019 than 2018, while eight states saw a birth increase. With fewer births in recent years and the number of deaths increasing, natural increase (or births minus deaths) has declined steadily over the past decade.

Executive Outlook 2020: Fintech and Data Analytics in Origination, Servicing and the Secondary Market

MBA NewsLink looks at 2020 with perspectives on mortgage technology from several industry executives: Pat Stone of Williston Financial Group; Mike Seminari and Seth Sprague, CMB, of STRATMOR Group; Raymond Eshaghian of Greenbox Loans; and Jane Mason of Clarifire.

Uptick in Fraud Risk Raises Eyebrows

First American Financial Corp., Santa Ana, Calif., said its monthly Loan Application Defect Index showed a jump in mortgage fraud risk for purchase transactions, the first such increase since last March.

Mortgage Vendor News & Views—Scott Roller

Today we focus on a subset of vendors whereby each have an intriguing model adding value to clients – and substantially serving borrowers too. Technology is blurring the lines, enabling innovation and expansion of traditional business boundaries.

Allen Price: Don’t Let Natural Disasters Become Servicing Disasters

Natural disasters have become seemingly commonplace, as every season seems to bring a major storm, flood, hurricane or wildfire somewhere in the country. These events obviously have devastating impacts on homeowners. But on one level or another, they have also revealed weaknesses among mortgage servicers and their ability to respond appropriately.

Survey: More Gen Zers Than Millennials Will Own Homes

Even as Millennials age into their prime home-buying years, they’re still not keeping up with past generations, said Zillow Inc., Seattle. Furthermore, the analysis said, Gen Z could end up overwhelming Millennials in homeownership competition.

ATTOM: November Foreclosure Activity Down 10% from October, 6% from Year Ago

ATTOM Data Solutions, Irvine, Calif., reported U.S. foreclosure activity fell by 10 percent in November from October and by 6 percent from a year ago.

Black Knight: Servicer Retention Rates Fall in Q3 Despite 3-Year High in Refinance Volumes

Black Knight, Jacksonville, Fla., said after hitting an 18-year low in Q4 2018, refinance lending has nearly doubled (+94%) over the past three quarters.