The Mortgage Bankers Association, in a letter last week to the Consumer Financial Protection Bureau, said as the Bureau assesses the effectiveness of its TRID Integrated Disclosure Rule it should reconsider provisions of the rule regarding wholesale creditors and brokered transactions.

Category: News and Trends

ATTOM: 2019 Average Home Seller Profits at Record $65,500

ATTOM Data Solutions, Irvine, Calif., said home sellers nationwide in 2019 realized a home price gain of $65,500 on the typical sale, up from $58,100 last year and up from $50,027 two years ago.

Black Knight ‘First Look:’ Strong Close to 2019 Pushes Mortgage Delinquency Rate to Near-Record Low

Black Knight, Jacksonville, Fla., said mortgage delinquencies fell by nearly 4% month-over-month to within 0.04% of the record low set this past May and more than 12% below from a year ago.

MBA Statement on CFPB Letter to Congress on QM Standard

On Jan. 17, Consumer Financial Protection Bureau Director Kathy Kraninger sent a letter to members of Congress, signaling proposed changes to the current Qualified Mortgage standard.

MBA, Trade Groups Urge FHFA to Use Caution on Changes to GSE UMBS Pooling Practices

The Mortgage Bankers Association, in a letter to Federal Housing Finance Agency Director Mark Calabria, urged caution on a proposed “waterfall approach” to pooling practices used by Fannie Mae and Freddie Mac in the Uniform Mortgage-Backed Security market, saying in its current form the proposal could have a “negative effect” on market liquidity, raise borrowing costs and reduce access to credit.

Breaking MBA Advocacy Update: CFPB Letter Signals Changes to QM Rule

On Friday, Consumer Financial Protection Bureau Director Kathy Kraninger sent a letter to Congress outlining the Bureau’s plan for a revised Qualified Mortgage Standard.

Zillow: Recovery Added $11.3 Trillion to U.S. Housing Value over Past Decade

Zillow, Seattle, said the total value of every home in the U.S. reached $33.6 trillion at the end of 2019, nearly as much as the GDP of the two largest global economies combined–the U.S. ($20.5 trillion) and China ($13.6 trillion).

Residential Remodeling Outlook: Slight Gains in 2020

National spending for improvements and repairs on owner-occupied homes is expected to rise “only modestly” this year, according to the Leading Indicator of Remodeling Activity by the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University, Cambridge, Mass.

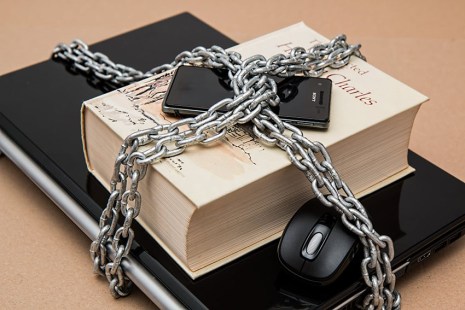

The New State Battleground: Privacy & Security

On January 1, the California Consumer Privacy Act (CCPA) became law–a warning shot across the bow of every real estate finance company in America.

CoreLogic: With QM GSE ‘Patch’ Set to Expire, Impact Warrants Closer Investigation

In two blog posts last week, CoreLogic, Irvine, Calif., examined the relationship between loan pricing and loan performance in context of the coming expiration of the Consumer Financial Protection Bureau’s Qualified Mortgage “GSE Patch.” The blogs noted little distinction in loan delinquencies in certain rate spread categories, but noted closer investigation is warranted.