In little more than a month, the coronavirus pandemic sent the housing market from a promising spring to a national emergency, said Redfin, Seattle.

Category: News and Trends

MBA Weekly Survey: Share of Mortgage Loans in Forbearance Rises to 5.95%

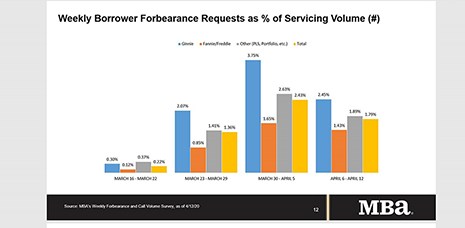

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans now in forbearance jumped from 3.74% of servicers’ portfolio volume in the prior week to 5.95% as of April 12.

MBA: 2019 IMB Production Volumes, Profits Rise

Independent mortgage banks and mortgage subsidiaries of chartered banks made an average profit of $1,470 on each loan they originated in 2019, up from $367 per loan in 2018, the Mortgage Bankers Association reported Friday in its Annual Mortgage Bankers Performance Report.

OCC Issues Guidance on FEMA/Flood Insurance Force-Place Requirements

The Office of the Comptroller of the Currency on Wednesday provided guidance to the Mortgage Bankers Association, addressing conflicts between a recent Federal Emergency Management Agency memo and banking agency flood insurance rules.

CFPB Issues Final Rule Raising HMDA Data Reporting Thresholds

The Consumer Financial Protection Bureau last week issued a final rule raising loan-volume coverage thresholds for financial institutions reporting data under the Home Mortgage Reporting Act.

FHFA, CFPB Announce Borrower Protection Program

The Federal Housing Finance Agency and the Consumer Financial Protection Bureau announced the Borrower Protection Program, a joint initiative that enables CFPB and FHFA to share servicing information to protect borrowers during the coronavirus national emergency.

Fannie Mae, Freddie Mac Extend URLA Implementation Timeline

Freddie Mac and Fannie Mae announced yesterday they will extend the implementation timeline for the redesigned Uniform Residential Loan Application and automated underwriting systems to support the industry during the COVID-19 pandemic.

Groundswell of Support Builds for Federal Liquidity Facility

Pete Mills, MBA Senior Vice President of Residential Policy and Member Engagement, said the groundswell is sending a strong message to regulators.

MBA Survey: Share of Mortgage Loans in Forbearance Continues to Climb

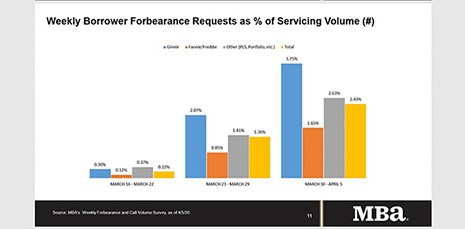

The surge in unemployment claims filed since mid-March resulting from the mitigation efforts to slow the spread of the coronavirus are straining household budgets and leading to more requests for mortgage forbearance. That is according to the Mortgage Bankers Association’s latest Forbearance and Call Volume Survey, which revealed the total number of loans in forbearance jumped from 2.73% to 3.74% during the week of March 30 to April 5.

CoreLogic: Annual Delinquency Rates Fall for 25th Consecutive Month

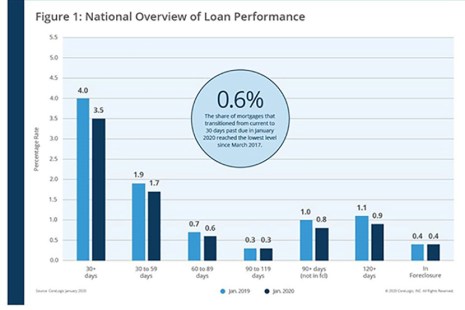

CoreLogic, Irvine, Calif., reported 3.5% of mortgages in some stage of delinquency in January, an 0.5 percentage point decline in the overall delinquency rate from a year ago.