In his latest blog, Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, discusses the importance of repayment options as lenders and consumers work together on forbearance strategies.

Category: News and Trends

Zillow: Coronavirus-Related Layoffs Threaten Housing Security for Minorities

Latinx, Asian and black workers are disproportionately represented in the food, arts and service industries that have been affected by mass layoffs and furloughs, said Zillow, Seattle.

GSEs: No Lump Sum Required at End of Forbearance

he Federal Housing Finance Agency, Fannie Mae and Freddie Mac issued announcements yesterday reiterating borrowers in forbearance with a Fannie Mae or Freddie Mac-backed mortgage are not required to repay the missed payments in one lump sum.

MBA: Share of Mortgage Loans in Forbearance Increases to Nearly 7%

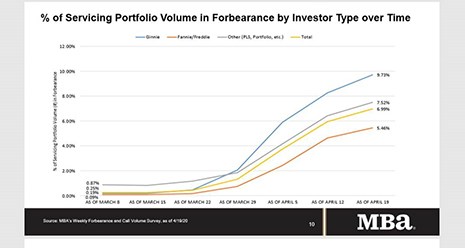

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 5.95% of servicers’ portfolio volume in the prior week to 6.99% as of April 19.

Britt Faircloth: Fairness in the Face of Crisis–Fair and Responsible Banking in the Midst of Chaos

As a compliance officer, I have always recognized that change is constant, and I accept that fact sometimes grudgingly. While regulatory change generally has ample implementation or lead time, March 2020 has brought a different kind of change; one that is significant, sudden and jarring. These days you can’t just ask who moved your cheese—assuming you could find cheese in the grocery store, that is—you must quickly and effectively adapt to an entirely new normal.

House Democrats Add Pressure on Administration for Mortgage Servicing Liquidity

Twenty-seven House Democrats sent a letter last week to Administration officials urging them to take further steps to allow mortgage borrowers to avoid delinquency and to support mortgage servicers who are working with these borrowers.

FHFA Allows FHLBs to Accept Paycheck Protection Program Loans as Collateral

The Federal Housing Finance Agency announced that Federal Home Loan Banks can accept Paycheck Protection Program loans as collateral when making loans (advances) to their members.

Black Knight ‘First Look:’ March Delinquencies First Sign of Coronavirus Impact

March is usually the strongest month of the year for mortgage performance, says Black Knight, Jacksonville, Fla. Not this year.

FHFA: GSEs Will Purchase Qualified Loans in Forbearance

The Federal Housing Finance Agency said it would approve purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria by Fannie Mae and Freddie Mac.

FHFA: Fannie Mae, Freddie Mac to Use 4-Month Advance Limit for Loans in Forbearance

The Federal Housing Finance Agency last week said it aligned Fannie Mae and Freddie Mac policies regarding servicer obligations to advance scheduled monthly principal and interest payments for single-family mortgage loans.