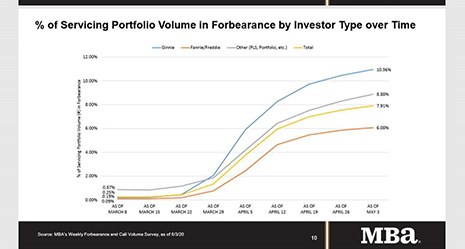

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased from 7.54% of servicers’ portfolio volume in the prior week to 7.91% as of May 3. MBA now estimates 4 million homeowners are now in forbearance plans.

Category: News and Trends

Fitch: Coronavirus to Drive More ‘Outside-the-Box’ Appraisals in RMBS

Fitch Ratings, New York, said traditional “full” pre-close home appraisals, viewed to be best practice, are becoming less common in the mortgage origination process as homes are more difficult to access during the coronavirus outbreak.

Survey: More than Half of Mortgage, Auto Borrowers Concerned About Making Upcoming Payments

Bankrate.com, New York, said more than half of mortgage and auto loan borrowers (54% of each) are concerned about their ability to make their payments over the next three months.

Ellie Mae: Low Rates Spur Refinance Activity to Historic High

Ellie Mae, Pleasanton, Calif., said refinance activity reached a record high in March for millennial borrowers as interest rates plummeted.

ATTOM: Pre-COVID-19, Steady Rates for Equity-Rich Homeowners

ATTOM Data Solutions, Irvine, Calif., said data gathered before the impact of the coronavirus pandemic showed equity-rich American homeowners dipped slightly in the first quarter, even as the share of seriously underwater homeowners edged up.

FHFA Extends Loan Processing Flexibilities for GSE Customers; Offers Tools for Renter Protection

The Federal Housing Finance Agency extended several loan origination flexibilities currently offered by Fannie Mae and Freddie Mac designed to help borrowers during the COVID-19 pandemic.

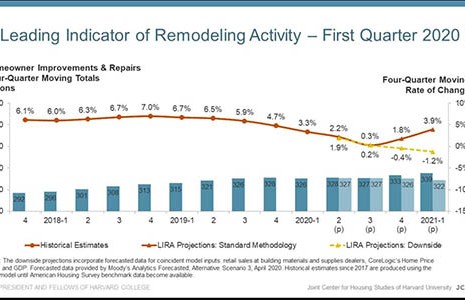

For Remodeling Market Outlook, an ‘Abrupt About-Face’

The coronavirus pandemic is taking its toll on many sectors of the housing market—and according to the Joint Center for Housing Studies of Harvard University, the previously solid home remodeling market is about to take a hit as well.

MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

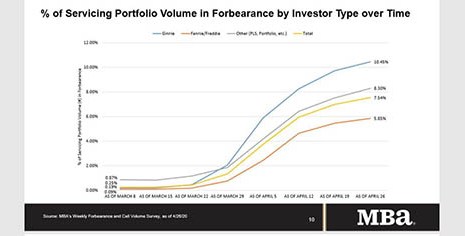

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, 3.8 million homeowners are now in forbearance plans.

MISMO Launches Initiative to Apply Digital Mortgage Standards to Loan Modification Process

MISMO, the Mortgage Industry Standards Maintenance Organization, seeks industry participants to join its initiative of applying digital mortgage standards, guidelines and best practices to the loan modification process.

Andrew Foster: Case-By-Case–Commercial Mortgage Forbearance Consideration Begins

While the hope remains that the recession will be short-lived with a strong recovery in the second half of 2020, commercial real estate typically lags the broader economy. Any quick relief for the commercial mortgage industry will be due in part to government relief efforts. It will take patience from market participants before a clear picture of various outcomes emerges, in part because so much of the CRE finance market impacted by COVID-19 is entering into forbearance agreements.