Fannie Mae, Washington, D.C., and Freddie Mac, McLean, Va., announced yesterday they will issue requests for proposals to hire an underwriting financial advisor to assist in developing and implementing a plan for recapitalizing and “responsibly ending” their conservatorship.

Category: News and Trends

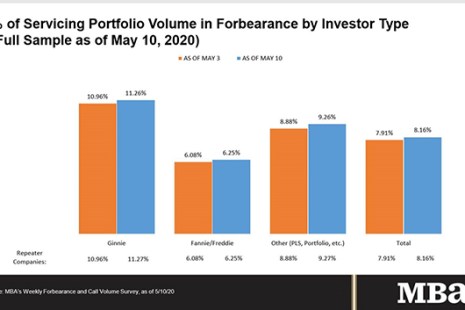

MBA: Share of Mortgage Loans in Forbearance Increases to 8.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

MBA Outlines Industry Priorities for Next COVID-19 Relief Package

The House has its wish-list for the next round of relief stemming from the coronavirus pandemic—a $3 trillion package that has no chance of passing into law. The Senate is working on its own version—which also has no chance of passing. To help Congress out, the Mortgage Bankers Association provided House and Senate leadership with its legislative priorities for the next relief package.

Neal Doherty: A Lender’s Guide to PPP Loan Forgiveness Timeline

A key provision of the CARES ACT is the Paycheck Protection Program (PPP), which authorizes small businesses to apply for loans guaranteed by the Small Business Administration. PPP loans can be forgiven, either in whole or part, under certain conditions. This article is intended as an overview of key steps in submitting and obtaining PPP loan forgiveness.

FHFA, FHA Extend Foreclosure/Eviction Moratorium to June 30

The Federal Housing Finance Agency and FHA said Thursday they would extend moratoria for Fannie Mae-, Freddie Mac- and FHA-based single-family mortgages until at least June 30.

FHFA, GSEs Offer Payment Deferral as Repayment Option for COVID-19 Forbearance Plans

The Federal Housing Finance Agency on Wednesday said Fannie Mae and Freddie Mac will employ a new payment deferral option allowing borrowers in COVID-19 related forbearance, who are able to return to making their normal monthly mortgage payment, the ability to repay their missed payments at the time the home is sold, refinanced, or at maturity.

Paul Fischer of Paradatec on What Mortgage Servicers Can Expect in Months Ahead

Paul Fischer is Director of Professional Services with Paradatec, Cincinnati.

Life Insurance Commercial Mortgage Index Drops Steeply

Trepp LLC, New York, said life insurance company mortgage returns dropped steeply during the first quarter as declining interest rates could not offset growing credit concerns.

Federal Agencies Launch Joint Mortgage, Housing Assistance Website on Coronavirus Impact

The Consumer Financial Protection Bureau, Federal Housing Finance Agency and HUD launched a new mortgage and housing assistance website designed to ensure homeowners and renters have current and accurate housing assistance information during the COVID-19 national emergency.

MBA Reports Rise in 1st Quarter Mortgage Delinquencies

Mortgage delinquencies rose in the first quarter as the economic effects of the coronavirus pandemic began to take hold, the Mortgage Bankers Association reported this morning.