Mortgage Bankers Association Vice Chair Kristy Fercho testified Friday before a House subcommittee on the real estate finance industry’s response to the coronavirus pandemic, saying mortgage servicers adapted to changing customer needs quickly and asking Congress to give the industry additional flexibility to address evolving market conditions.

Category: News and Trends

Analysts Downgrade Hotel Forecast Again

STR and Tourism Economics once again updated their hotel sector forecast. They now expect a 57.5 percent revenue per available room decline this year and a 48 percent RevPAR increase next year.

John Walsh: Tax Service – A New Era

For decades, tax service has gone unchanged. There are many efforts to change this dynamic; layering in new technology for servicers to engage with their tax vendor and improving transparency in a historically monochromatic space.

MBA Mortgage Action Alliance ‘Call to Action’ Urges Support of House Bill Supporting Access to Credit

The Mortgage Action Alliance, the grassroots advocacy arm of the Mortgage Bankers Association, issued a “Call to Action” urging its members to contact their House representative in support of legislation that would promote consumer access to credit during the coronavirus pandemic.

FHFA Re-Proposes Capital Rule to Move GSEs from Conservatorship

The Federal Housing Finance Agency last week issued a notice of proposed rulemaking that establishes a new regulatory capital framework for Fannie Mae and Freddie Mac. The proposed rule is a re-proposal of the notice of proposed rulemaking published in July 2018.

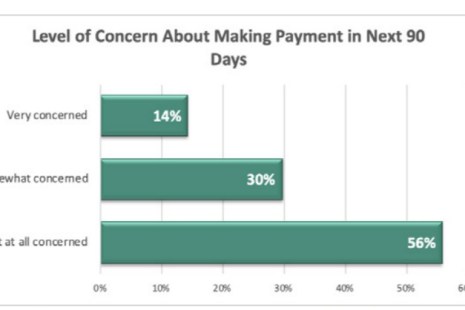

STRATMOR Study Lays Bare Uncertainties of COVID-19 Impact on Housing Market

A study by STRATMOR Group, Greenwood Village, Colo., shows just how quickly and hard-hitting the coronavirus pandemic has been on homeowners.

MBA, Trade Groups Ask SEC to Amend Reg AB II Disclosure Requirements

The Mortgage Bankers Association and other industry trade groups sent a letter last week to the Securities and Exchange Commission, asking it to consider amendments to Reg AB II disclosure requirements that will help to restore the registered segment of the private-label securities market.

FHFA Announces Refi/Home Purchase Eligibility for GSE Borrowers in Forbearance

Fannie Mae and Freddie Mac issued temporary guidance May 19 regarding the eligibility of borrowers who are in forbearance, or have recently ended their forbearance, looking to refinance or buy a new home.

‘MBA Is Meeting this Crisis Head-On’

WASHINGTON, D.C.—“These are no normal times.” With those words, Mortgage Bankers Association Robert Broeksmit, CMB, not only described the past few months, but also set the tone for the future of the real estate finance industry and life in general.

House Passes $3 Trillion COVID-19 Relief Package; MBA Letter Details Industry Priorities

The House on Friday passed a massive $3 trillion pandemic relief bill on Friday that includes several key housing provisions advocated by the Mortgage Bankers Association.