What follows are findings from a survey of senior mortgage executives I conducted in the first half of May. Due to cancellation of MBA’s National Secondary Market Conference, this survey was completed over the phone rather than face to face, as has been the case in the 23 preceding surveys done since 2008. Normally the surveys are conducted at the secondary conference as well as at the MBA Annual Convention every October.

Category: News and Trends

FHFA Publishes Credit Risk Transfer Spreadsheet Tool

The Federal Housing Finance Agency June 2 published a Credit Risk Transfer spreadsheet tool based on the re-proposed capital rule for Fannie Mae and Freddie Mac.

(#MBA Live) Housing, Mortgage Markets Show Resiliency, Agility

With all that has hit the mortgage industry over the past several months, Mortgage Bankers Association Chief Economist Mike Fratantoni has a positive message for mortgage lenders and servicers: “It seems like the industry has done a fantastic job of finding solutions in this crazy environment,” Fratantoni said during MBA Live: Technology Solutions Conference.

Andrew Foster: Travel Nosedive Knocks Hospitality Industry

COVID-19 has impacted the entire United States and commercial real estate is no exception; however, no property type is quicker to experience the impacts of a downturn than lodging, where rental rates reset daily.

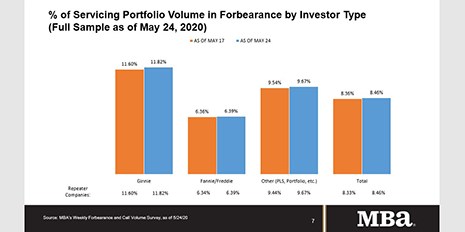

MBA: Share of Mortgage Loans in Forbearance Increases to 8.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.46% of servicers’ portfolio volume from 8.36% the prior week as of May 24. MBA estimates 4.2 million homeowners are now in forbearance plans.

Distressed Debt Monitor: Q&A With SitusAMC’s Tim Mazzetti, CMB

Tim Mazzetti, CMB, leads SitusAMC’s Servicing & Asset Management division. He has more than 30 years of broad-based experience in the commercial real estate industry.

California County Ends Controversial PACE Loan Program

Forget the coronavirus—if you want to raise the blood pressure of a mortgage lender or servicer, just say these two words: “PACE loan.”

Investors Prefer Debt Investment During COVID-19 Era

Real estate debt investment has become more attractive relative to equity investment during the COVID-19 pandemic, institutional investors said.

To the Point with Bob: FHFA’s Capital Rule and How it Fits into Housing Finance Reform

Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, in his newest blog, discusses latest developments involving the Federal Housing Finance Agency and its re-proposed capital framework for Fannie Mae and Freddie Mac.

‘Zombie’ Property Stats Hold Steady Amid Foreclosure Moratorium

ATTOM Data Solutions, Irvine, Calif., said the percentage of “zombie” properties—vacant properties facing foreclosure—held steady in the second quarter as nationwide moratoria on foreclosures kept activity to a minimum.