The May 20 dam breaks caused unprecedented damage and flooding in four Michigan counties. Throw in the coronavirus pandemic and you have a disaster unique in scope—and we’re only halfway through 2020.

Category: News and Trends

Quote

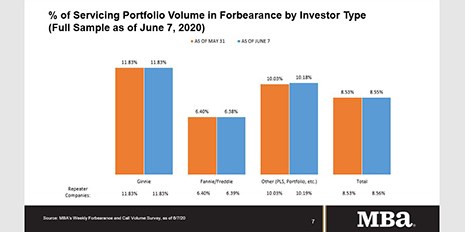

“Half of the servicers in our sample saw the forbearance share decline for at least one investor category. Although there continues to be layoffs, the job market does appear to be improving, and this is likely leading to many borrowers in forbearance deciding to opt out of their plan.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

FHFA to Re-Propose Updated Minimum Financial Eligibility Requirements for GSE Sellers/Servicers

The Federal Housing Finance Agency, citing “recent market events,” announced it will re-propose updated minimum financial eligibility requirements for Fannie Mae and Freddie Mac Seller/Servicers.

MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.

April Sees ‘Historic’ Hotel Profitability Drop

U.S. hotel profitability metrics cratered during April, reported STR, Hendersonville, Tenn. During April, the sector saw total revenue per available room fall nearly 93 percent year-over-year and gross operating profit per available room fall 116.9 percent to a $17.98 loss per room.

FHFA Extends GSE COVID-Related Loan Processing Flexibilities Through July

The Federal Housing Finance Agency extended several loan origination flexibilities currently offered by Fannie Mae and Freddie Mac designed to help borrowers during the COVID-19 national emergency through at least July 31.

MBA, Trade Groups Oppose ‘Fundamentally Flawed’ California COVID Relief Bill

The Mortgage Bankers Association and nearly two dozen other industry trade groups sent a letter this week to California legislators, strongly opposing as “fundamentally flawed” and “disruptive” a broad-brush bill aimed at assisting state residents experiencing financial difficulties amid the coronavirus pandemic.

Zillow: Newly Unemployed Service Workers Owe $1.7 Billion/Month in Housing Payments

Zillow, Seattle, said its analysis found more than $1.7 billion in rent and mortgage payments is owed each month by U.S. service-sector workers currently receiving unemployment benefits as a result of the coronavirus pandemic — payments that could be in jeopardy if expanded local and federal unemployment assistance fades or workers remain without incomes longer than expected.

ATTOM: Home-Flipping Reaches 14-Year High in 1Q; Returns Fall to 9-Year Low

ATTOM Data Solutions, Irvine, Calif., said its first-quarter U.S. Home Flipping Report showed 53,705 single-family homes and condominiums in the United States flipped in the first quarter, the highest number since 2006.

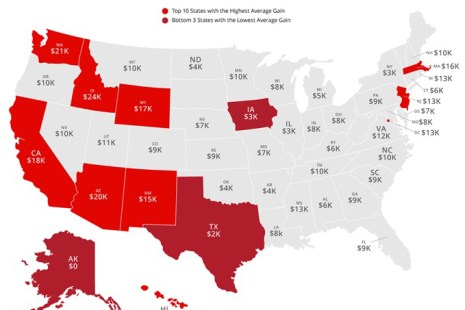

CoreLogic: Borrowers Gain $6 Trillion in Home Equity Since End of Great Recession

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages—representing 63% of all properties—have seen their equity increase by 6.5% year over year, representing a gain of $590 billion since 2019.