The Mortgage Bankers Association, in a letter to Federal Housing Finance Agency Director Mark Calabria, urged FHFA to expand membership in the Federal Home Loan Bank system to include captive insurers, including mortgage real estate investment trusts and independent mortgage banks.

Category: News and Trends

Quote

“Fewer homeowners in forbearance underscores the continued improvements in the job market, and provides another sign of the fundamental health of the housing market, which has rebounded considerably over the past several weeks.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

FHA Issues Temporary Waiver Suspending Early Payment Default Reviews

The Federal Housing Administration yesterday issued a temporary waiver of its Single Family Housing Policy Handbook4000.1 to temporarily suspend the requirement that mortgagees select and review all Early Payment Defaults on a monthly basis.

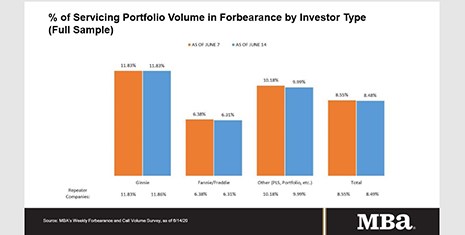

MBA: Share of Mortgage Loans in Forbearance Falls to 8.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14.

CFPB Issues Notices of Rulemaking to Address GSE ‘Patch’

The Consumer Financial Protection Bureau Monday issued two Notices of Proposed Rulemaking to address the impending expiration of the Government-Sponsored Enterprises Patch, also known as the GSE Patch, which affects nearly one million mortgage loans.

CBRE Forecasts Hotel Demand Recovery by Late 2022

After suffering the greatest performance declines in U.S. history, the nation’s hotels will likely benefit from a relatively rapid economic turnaround in 2021 and 2022, said CBRE Hotels, Atlanta.

Richard Ferguson: Preserving Down Payment Options in a Disruptive Market

There is no downplaying the destruction the COVID-19 pandemic has had on our economy and the financial lives of millions of Americans. But it is also threatening the up-and-coming generation of home buyers, particularly minorities.

Sen. Fischer Reintroduces Bill to Create CFPB Commission; MBA, Trade Groups Send Letter of Support

Sen. Deb Fischer, R-Neb., reintroduced legislation this week that would change the structure of the Consumer Financial Protection Bureau from a single director to a bipartisan commission of five individuals.

FHFA, FHA Extend Foreclosure/Eviction Moratorium to Aug. 31

The Federal Housing Finance Agency and HUD announced Fannie Mae, Freddie Mac and FHA will extend their single-family moratorium on foreclosures and evictions until at least August 31.

MBA: 1QCommercial, Multifamily Mortgage Delinquencies Remain Low

Commercial and multifamily mortgage delinquencies remained low at the end of the first quarter, the Mortgage Bankers Association said in its first quarter Commercial/Multifamily Delinquency Report.