Moody’s Investors Service, New York, said the supply and demand outlook for most property types in the securitized commercial real estate market fell “drastically” in the first quarter.

Category: News and Trends

GSEs Extend Multifamily Forbearance

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will allow servicers to extend forbearance agreements for multifamily property owners with existing forbearance agreements.

Supreme Court Rules Independent CFPB Director Unconstitutional

A divided Supreme Court on Monday ruled the current structure of the Consumer Financial Protection Bureau, with power resting with a single, independent director, is unconstitutional, but stopped short of allowing the Trump Administration to dismantle the agency.

Quote

“The level of forbearance requests remains quite low as of mid-June. The rebound in the housing market is likely one of the factors that is providing confidence to both potential homebuyers and existing homeowners during these troubled times.”

–MBA Chief Economist Mike Fratantoni.

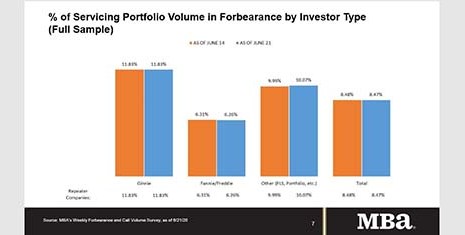

MBA: Share of Mortgage Loans in Forbearance Dips to 8.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 8.47%of servicers’ portfolio volume as of June 21, a slight decrease from 8.48% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

May Commercial Real Estate Sales Slump

Real Capital Analytics, New York, reported commercial property sales sank again in May as the COVID-19 crisis kept investors on the sidelines.

MBA: 1st Quarter Commercial/Multifamily Mortgage Debt Outstanding Up 1.7%

Commercial/multifamily mortgage debt outstanding rose by $61.0 billion (1.7 percent) in the first quarter, according to the Mortgage Bankers Association’s quarterly Commercial/Multifamily Mortgage Debt Outstanding report.

Fitch Ratings: CRE Defaults Likely To Rise After Forbearance Periods

Fitch Ratings, New York, said it anticipates commercial real estate loan defaults will rise at the end of forbearance periods.

21 Years to Save for a Down Payment, Survey Finds

U.S. Mortgage Insurers, an association representing private mortgage insurance companies, said its annual state-by-state report on low down payment mortgage lending found saving for a 20 percent down payment could take potential homebuyers 21 years — three times the length of time it could take to save a 5 percent down payment.

CFPB Issues Interpretive Rule on Determining Underserved Areas; Final Rule on Loss Mitigation Options for Homeowners with COVID-Related Hardships

The Consumer Financial Protection Bureau issued an interpretive rule to provide guidance to creditors and other persons involved in the mortgage origination process about the way in which the Bureau determines which counties qualify as “underserved” for a given calendar year.