The Mortgage Bankers Association asked HUD to withhold publication of its final disparate rule, citing “legitimate concerns” that the rule erodes protections needed to combat housing discrimination and systemic inequality.

Category: News and Trends

MISMO Launches Initiative to Facilitate Servicing Transfers

MISMO®, the mortgage industry’s standards organization, is seeking industry participants to collaborate on a new initiative to facilitate servicing transfers.

FHA Proposes Streamlined Single-Family Servicing Policies; CFPB Touts Benefits of Credit Builder Loans

The Federal Housing Administration last week published proposed revisions to its Single-Family servicing policies, designed to remove “unnecessary barriers” for homeowners seeking mortgage payment relief, achieve operational consistency with industry standard best practices and reduce burdens incurred by the industry when servicing an FHA-insured mortgage portfolio.

ATTOM: Foreclosure Filings in 1st Half of 2020 Fall to Record Low

Things are kind of dicey in the housing finance market right now, with the economic impact of the coronavirus spiking unemployment and mortgage forbearance. But ATTOM Data Solutions, Irvine, Calif., says for now there is a silver lining.

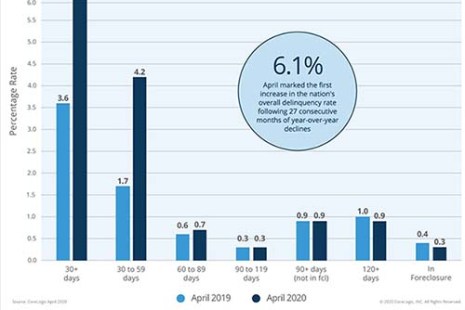

CoreLogic: Mortgage Delinquencies Hit Downslope

CoreLogic, Irvine, Calif., said April early stage mortgage delinquencies jumped to levels that exceeded even those during the Great Recession.

MBA Urges House to Support FY2021 T-HUD Priorities

The Mortgage Bankers Association, in a July 14 letter to House leadership, urged the House to approve key industry-supported provisions for FHA in the federal government’s fiscal 2021 proposed budget.

Hotel Sector Bouncing Back But Faces Continued Threats

CBRE, Los Angeles, said the hotel sector has seen 10 straight weeks of occupancy gains, but the recent COVID-19 diagnosis increase threatens to derail its progress.

Quote

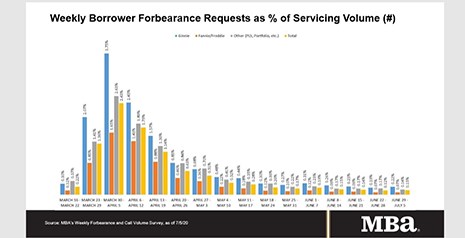

“The share of loans in forbearance continues to decrease, as more workers are brought back from temporary layoffs. However, our survey reveals a notable shift in the location of many FHA and VA loans, which have been bought out of Ginnie Mae pools – predominantly by bank servicers – and moved onto bank balance sheets. As a result, there was a sharp drop in the share of Ginnie Mae loans in forbearance.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

MBA: Share of Loans in Forbearance Falls 4th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 21 basis points to 8.18% of servicers’ portfolio volume for the week of July 5, from 8.39% the week before. MBA now estimates 4.1 million homeowners are in forbearance plans, down from 4.2 million the previous week.

MBA: Share of Loans in Forbearance Drops for 4th Straight Week

MBA Forbearance Survey lede sentence HERE