The Mortgage Bankers Association and 18 other groups asked the Federal Housing Administration to revise its treatment of borrowers’ student loan debt to better align with the standards at the GSEs, VA and USDA.

Category: News and Trends

FHFA Extends Temporary Policy Allowing Purchase of Qualified Loans in Forbearance to Aug. 31

The Federal Housing Finance Agency approved an extension of the temporary policy that allows for the purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria set by Fannie Mae and Freddie Mac. The policy is extended for loans originated through August 31.

MBA: Home Equity Lending Growth Hindered by Alternative Products and COVID-19

Home equity loan debt outstanding and borrower utilization rates declined in 2019 and mortgage lenders anticipate originations to fall again this year before increasing modestly in 2021, the Mortgage Bankers Association reported.

FHFA: Multifamily Owners in Forbearance Must Inform Tenants of Eviction Suspension, Tenant Protections

The Federal Housing Finance Agency announced Thursday multifamily property owners with mortgages backed by Fannie Mae or Freddie Mac who enter into a forbearance agreement must inform their tenants about protections during the property owner’s forbearance and repayment periods.

MBA, Trade Groups Ask Congress to Avoid Adding New Credit Reporting Provisions

The Mortgage Bankers Association and other industry trade associations asked Congress to refrain from adding new credit reporting provisions that may negatively affect consumers as Congress considers new COVID-19 response legislation.

MBA Shares Recommendations With CFPB Regarding LIBOR Transition

The Mortgage Bankers Association shared recommendations with the Consumer Financial Protection Bureau regarding the bureau’s proposed rule to amend Regulation Z to facilitate the transition away from LIBOR.

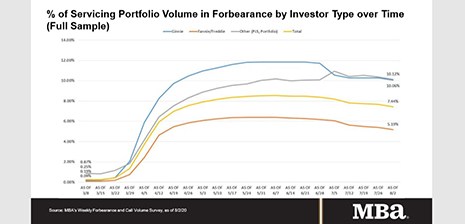

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

Quote

“The share of loans in forbearance declined at a more rapid pace last week, with many borrowers who had been making payments while in forbearance deciding to exit. New forbearance requests increased, but are still well below the level of exits. Some of the decline in the share of Ginnie Mae loans in forbearance was due to additional buyouts of delinquent loans from Ginnie Mae pools, which result in these FHA and VA loans being reported in the portfolio category.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

Americans Now Lean Toward Stocks, Not Housing, As Favorite Long-Term Investment

Real estate, long the favorite way to invest and for many a path to wealth, fell to second place this year as more Americans take a gamble on the stock market, according to a new report from Bankrate.com, New York.

Office Sector Woes Continue

Analysts say the pandemic shutdown and millions of job layoffs are weighing heavily on the office sector.