The Mortgage Bankers Association shared recommendations with the Consumer Financial Protection Bureau regarding the bureau’s proposed rule to amend Regulation Z to facilitate the transition away from LIBOR.

Category: News and Trends

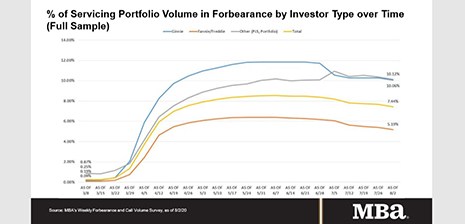

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

Quote

“The share of loans in forbearance declined at a more rapid pace last week, with many borrowers who had been making payments while in forbearance deciding to exit. New forbearance requests increased, but are still well below the level of exits. Some of the decline in the share of Ginnie Mae loans in forbearance was due to additional buyouts of delinquent loans from Ginnie Mae pools, which result in these FHA and VA loans being reported in the portfolio category.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

Americans Now Lean Toward Stocks, Not Housing, As Favorite Long-Term Investment

Real estate, long the favorite way to invest and for many a path to wealth, fell to second place this year as more Americans take a gamble on the stock market, according to a new report from Bankrate.com, New York.

Office Sector Woes Continue

Analysts say the pandemic shutdown and millions of job layoffs are weighing heavily on the office sector.

MBA, Trade Groups Ask Congress to Extend Troubled Debt Restructurings Relief Period

The Mortgage Bankers Association and a half-dozen other industry trade groups this week asked Congress to extend the “covered period” under the Troubled Debt Restructurings relief under section 4013 of …

The CMBS Market During the Pandemic: A Conversation with Moody’s Investors Service

MBA NewsLink interviewed Keith Banhazl, Victor Calanog and Nick Levidy from Moody’s, New York.

Momentum Builds as 2nd FHLB Accepts eNotes

Last month, the Federal Home Loan Bank of Des Moines became the first of the 11-member FHLB system to announce it would accept residential mortgage electronic promissory notes—eNotes—as collateral. Now, a second FHLB has jumped on the eNotes bandwagon.

Quote

“The job market has cooled somewhat over the past few weeks, with layoffs increasing and other indications that the economic rebound may be losing some steam because of the rising COVID-19 cases throughout the country.”

–MBA Senior Vice President and Chief Economist Mike Fratantoni.

MBA: 2019 Multifamily Lending Up 7% to Record High

Fueled by strong market fundamentals and low interest rates, 2,589 different multifamily lenders provided $364.4 billion in new mortgages in 2019 for apartment buildings with five or more units, according to the Mortgage Bankers Association’s 2019 Multifamily Lending Report.