It can be challenging to raise capital for public companies involved in commercial real estate lending against a backdrop of falling stock prices. This has led to an inward focus on activities such as asset management and building liquidity for public mortgage REITs, making these market participants less active for new loan originations.

Category: News and Trends

GSEs, FHA Extend Foreclosure/REO Eviction Moratoria

The government-sponsored enterprises and HUD announced they would extend foreclosure moratoria to all GSE-backed mortgages and FHA-backed mortgages, respectively and extend eviction moratoria through at least Dec. 31.

Office Vacancy Rate Could Reach 20% in 2022

The office sector saw downward pressure even before the COVID-19 crisis. Now, burdened with a shift toward remote working, it could be particularly hard hit in the coming years, said Moody’s Analytics, New York.

‘Zombie’ Foreclosures on the Rise

ATTOM Data Solutions, Irvine, Calif., said its third quarter Vacant Property and Zombie Foreclosure Report showed 1.5 million residential properties in the United States are vacant, representing 1.6 percent of all homes. Nearly 4 percent of these vacant homes face foreclosure—so-called “zombie foreclosures.”

FHFA Extends GSE Forbearance Purchases through Sept. 30; Extends COVID-Related Loan Processing Flexibilities

The Federal Housing Finance Agency announced Wednesday that Fannie Mae and Freddie Mac will extend buying qualified loans in forbearance and several loan origination flexibilities through September 30.

FHFA Delays Refi Fee Implementation to Dec. 1

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac would delay implementation of a controversial Adverse Market Refinance Fee by two months, to Dec. 1.

Quote

“We welcome [last week’s] announcement from the FHFA amending the recently announced Adverse Market Refinance Fee from Fannie Mae and Freddie Mac. Extending the effective date will permit lenders to close refinance loans that are in their pipelines and honor the rate lock commitments they made to their borrowers, ensuring that economic relief in the form of record low interest rates will continue to flow to consumers.”

–MBA President & CEO Robert Broeksmit, CMB.

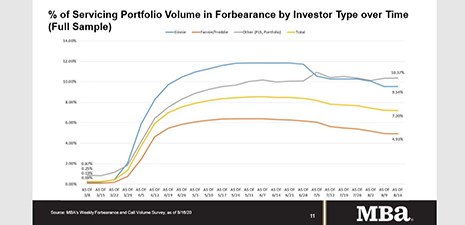

MBA: Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by just 1 basis point, from 7.20% of servicers’ portfolio volume as of Aug. 16 from the prior week. MBA estimates 3.6 million homeowners are in forbearance plans.

Quote

“The extremely high rate of initial claims for unemployment insurance and high level of unemployment remain a concern, and are indications of the challenges many households are facing. While new forbearance requests remain low, particularly for Fannie Mae and Freddie Mac loans, the pace of exits from forbearance has declined for two straight weeks.”

–MBA Chief Economist Mike Fratantoni.

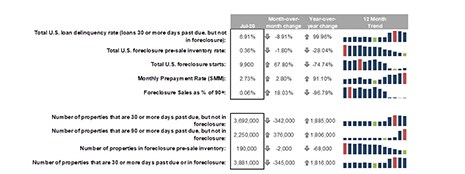

Black Knight: Mixed Results on Delinquencies; Monthly Prepayment Activity Hits 16-Year High

Black Knight, Jacksonville, Fla., said its “First Look” Mortgage Monitor showed while overall delinquencies continued to show improvement, serious delinquencies rose by 376,000 and are now up more than 1.8 million from their pre-pandemic levels.