Former U.N. Ambassador to the United Nations Andrew Young keynotes an important General Session at MBA Annual20, which runs online Oct. 19-21.

Category: News and Trends

Black Knight: Refi Surge Spurs Record Quarterly Origination Volume

Black Knight, Jacksonville, said record-low mortgage rates triggered a surge in refinancing in the second quarter, leading to the largest quarterly origination volume dating back to 2000.

CMBS Delinquency Rate Falls from Near-Record High

The commercial mortgage-backed securities delinquency rate fell again in August after posting a big decline July.

Regrets? For Some Homeowners During Pandemic, a Few

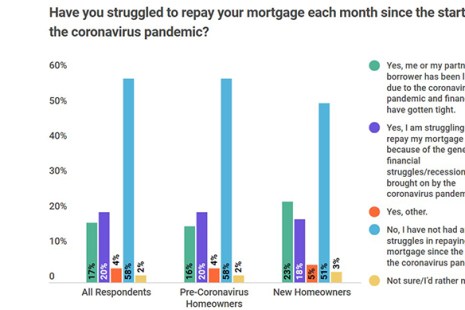

A new survey from LendEDU, Hoboken, N.J., finds more than half of new homeowners regret taking out a mortgage during the coronavirus pandemic, with most of them citing a job layoff as the reason for their angst.

60 Percent of Americans Saving More Compared to Last Year

A new survey from CNBC, Englewood Cliffs, N.J., an Acorns, San Mateo, found Americans are saving more and spending less compared to before the pandemic with 60% of respondents call themselves “savers,” up from 54% a year ago.

Quote

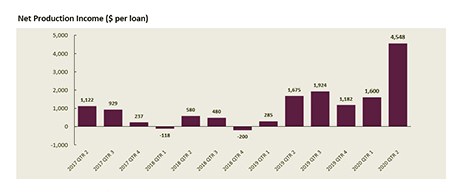

“Mortgage servicing right markdowns and amortization continued, and there was a loss of servicing income from elevated default activity. Despite these servicing losses, 96 percent of firms in the report posted overall profitability for the second quarter.”

— Marina Walsh, MBA Vice President of Industry Analysis.

MBA: Strong Borrower Demand, Low Rates Fuel 2Q IMB Production Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $4,548 on each loan they originated in the second quarter, up from $1,600 per loan in the first quarter, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

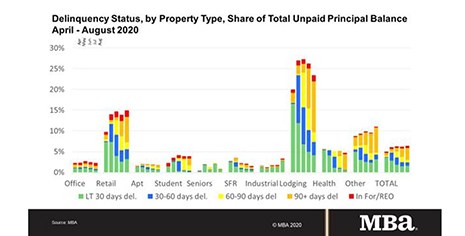

MBA: Pandemic Takes Aim at Commercial, Multifamily Mortgage Delinquency Rates

The coronavirus pandemic had a “dramatic and immediate impact” on delinquency rates for some mortgages backed by commercial and multifamily properties in the second quarter, although most continued to perform well, the Mortgage Bankers Association said today in two reports.

MBA Asks FHFA to Develop New GSE Capital Framework

The Mortgage Bankers Association asked the Federal Housing Finance Agency to restructure the capital framework for Fannie Mae and Freddie Mac, moving from past business models to a market utility approach that enables them to meet all of their obligations.

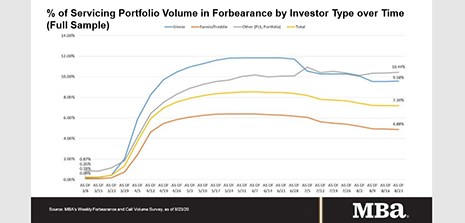

MBA: Share of Mortgage Loans in Forbearance Flat at 7.20%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the percentage of loans in forbearance stayed flat for the second straight week, holding at 7.20% as of Aug. 23.