Mortgage Bankers Association Chair-Elect Susan Stewart kicked off the MBA Risk Management, Quality Assurance and Fraud Prevention Forum with an astute observation: the coronavirus pandemic has put such issues “front and center.”

Category: News and Trends

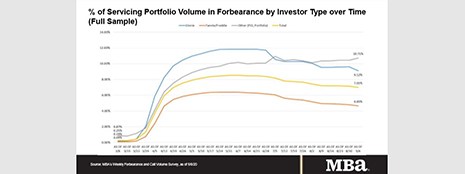

MBA: Share of Mortgage Loans in Forbearance Declines to 7.01%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 15 basis points last week to 7.01% of mortgage servicers’ portfolio volume as of Sept. 6, down from 7.16% the previous week. According to MBA estimates 3.5 million homeowners are in forbearance plans.

Mortgage Rates Fall to Record Low

The 30-year fixed-rate mortgage averaged 2.86 percent last week, the lowest rate since at least 1971, reported Freddie Mac, McLean, Va.

Quote

“Many courthouses across the country have been closed or have had their caseloads dramatically reduced during the pandemic. It will be interesting to see if foreclosure starts continue to increase as these courthouses begin to re-open.”

–Rick Sharga, Executive Vice President at RealtyTrac.

Properties with Foreclosure Filings Uptick as Pandemic Continues

ATTOM Data Solutions, Irvine, Calif., reported nearly 10,000 U.S. properties with foreclosure filings in August, up 11 percent from a month ago but down 81 percent from a year ago.

Most Consumers Plan to Maintain Increased Digital Banking after Pandemic

COVID-19 has permanently changed how consumers interact with their financial services organization, reported BAI, Chicago.

Mortgage Credit Availability Decreased in August

Mortgage credit availability decreased in August according to the Mortgage Credit Availability Index, a report from the Mortgage Bankers Association that analyzes data from Ellie Mae’s AllRegs® Market Clarity® business information tool.

MBA Responds to CFPB’s Proposed Rule Revising the General Qualified Mortgage Definition

Last Tuesday, the Mortgage Bankers Association commented on the Consumer Financial Protection Bureau’s proposed rule to amend its General Qualified Mortgage (QM) loan definition in Regulation Z.

Mortgage Applications Increase in MBA Weekly Survey

Mortgage applications increased 2.9 percent from one week earlier, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Sept. 4.

MBA: Share of Mortgage Loans in Forbearance Declines to 7.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans now in forbearance decreased 4 basis points to 7.16 percent of servicers’ portfolio volume as of Aug. 30.