With just under two decades wearing different hats in the commercial real estate industry before joining the bank, Bailey is a CRE subject matter expert in the Atlanta Fed’s Supervision, Regulation and Credit division. In addition to previous roles as an appraiser, consultant and property developer, Bailey holds CCIM and CRE designations. MBS Newslink interviewed Bailey to get his perspective on the current environment.

Category: News and Trends

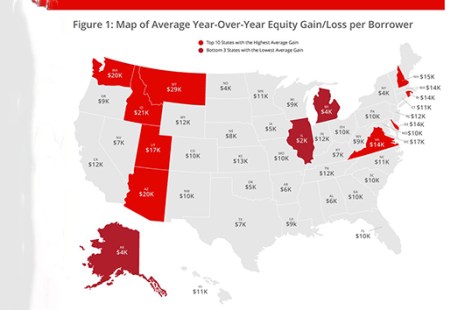

CoreLogic: Despite Pandemic, Homeowners Gain $620 Billion in Equity

CoreLogic, Irvine, Calif., said its 2nd Quarter Home Equity Report shows U.S. homeowners with mortgages—which account for 63% of all properties—have seen their equity increase by 6.6% year over year. This represents a collective equity gain of $620 billion and an average gain of $9,800 per homeowner from a year ago.

MBA, Realtors Voice Opposition to Potential VA Fee Increase

The Mortgage Bankers Association and the National Association of Realtors yesterday sent a letter to House and Senate leaders in opposition to possible legislation that could increase funding fees to veterans’ homeownership benefits.

Quote

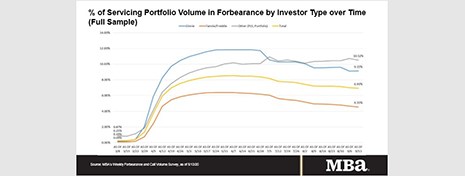

“The share of loans in forbearance has dropped to its lowest level in five months, driven by a consistent decline in the GSE share in forbearance. However, not only the did the share of Ginnie Mae loans in forbearance increase, new requests for forbearance for these loans have increased for two consecutive weeks. While housing market data continue to show a quite strong recovery, the job market recovery appears to have slowed, and we are seeing the impact of this slowdown on FHA and VA borrowers in the Ginnie Mae portfolio.”

–MBA Chief Economist Mike Fratantoni.

MBA: Loans in Forbearance Fall to Lowest Level in 5 Months

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

Institutional Investors Expect Negative Full-Year Returns

Institutional investors expect negative full-year commercial real estate returns, the Pension Real Estate Association’s Consensus Forecast Survey reported.

Leading During Turbulent Times (MBA LIVE)

Risk managers face many challenges during this turbulent time, but the mortgage industry has largely been successful in weathering this pandemic, panelists said Wednesday during the MBA Live Risk Management, QA and Fraud Prevention Forum.

GSEs: Recession-Era QC Has Lenders Well-Prepared for Current Crisis (MBA LIVE)

Representatives of Fannie Mae and Freddie Mac said lenders thus far have weathered the coronavirus pandemic very well, thanks to lessons learned from the Great Recession.

RIHA Study: COVID-19’s Impact on Jobs, Ability to Make Housing, Student Debt Payments

During the first three months of the COVID-19 pandemic, nearly 11 million households fell behind on their rent or mortgage payments and 30 million individuals missed at least one student loan payment, according to new research released Sept. 17 by the Mortgage Bankers Association’s Research Institute for Housing America.

MBA, Trade Groups Ask Congress to Continue Flood Insurance Program

With the National Flood Insurance Programs set to expire—yet again—the Mortgage Bankers Association and nearly two dozen industry trade groups asked Congress for another program extension as policymakers work on a longer-term solution.