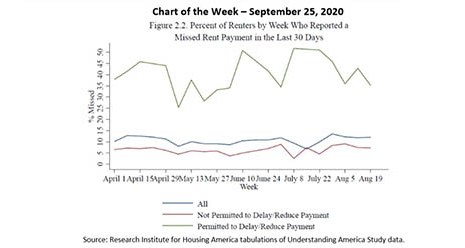

On September 17, the Research Institute for Housing America, MBA’s think tank, released a special report on housing-related financial distress during the second quarter – the first three months of the pandemic in the U.S.

Category: News and Trends

Fitch: Secular Shifts Force U.S. Commercial Real Estate to Adapt

Fitch Ratings, New York/London, said post-pandemic, many U.S. commercial real estate segments will be transformed by the way space is used, which will have long-term consequences for property performance and financeability.

Chris Joles: Collaboration in Risk

Today’s financial services risk managers face two recurring issues. First, our work makes some people feel defensive; and second, we have to analyze complex business lines and correctly identify the right issues to focus upon.

Black Knight First Look: Early-Stage Delinquencies Improve, Serious Past-Due Loans Rise

Black Knight, Jacksonville, Fla., issued its monthly First Look Mortgage Monitor, reporting the divergence between early-stage delinquencies and seriously past-due mortgages continues to widen as fewer delinquent loans cured to current status in August.

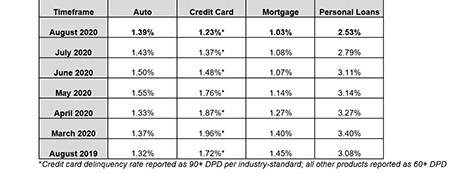

Consumers Resilient Despite Broader Economic Challenges

Serious delinquency rates in August improved once more across all consumer credit segments even as the number of people in accommodation programs dropped for the second consecutive month, reported TransUnion, Chicago.

MBA Advocacy Spurs Crackdown on Deceptive VA Loan Marketing

The settlements signal a remarkable effort by the CFPB to hold lenders accountable for their dealings with the nation’s veterans—and the culmination of advocacy by the Mortgage Bankers Association to protect earned benefits for servicemembers, veterans and surviving spouses.

Atlanta Fed’s Brian Bailey, CRE, Dishes on Commercial Real Estate Risks

With just under two decades wearing different hats in the commercial real estate industry before joining the bank, Bailey is a CRE subject matter expert in the Atlanta Fed’s Supervision, Regulation and Credit division. In addition to previous roles as an appraiser, consultant and property developer, Bailey holds CCIM and CRE designations. MBS Newslink interviewed Bailey to get his perspective on the current environment.

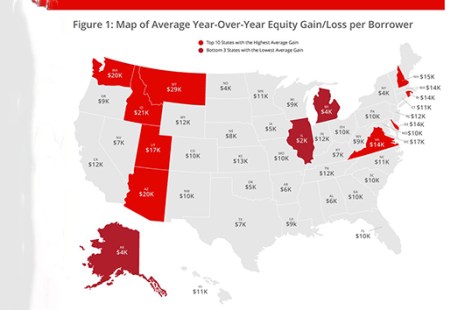

CoreLogic: Despite Pandemic, Homeowners Gain $620 Billion in Equity

CoreLogic, Irvine, Calif., said its 2nd Quarter Home Equity Report shows U.S. homeowners with mortgages—which account for 63% of all properties—have seen their equity increase by 6.6% year over year. This represents a collective equity gain of $620 billion and an average gain of $9,800 per homeowner from a year ago.

MBA, Realtors Voice Opposition to Potential VA Fee Increase

The Mortgage Bankers Association and the National Association of Realtors yesterday sent a letter to House and Senate leaders in opposition to possible legislation that could increase funding fees to veterans’ homeownership benefits.

Quote

“The share of loans in forbearance has dropped to its lowest level in five months, driven by a consistent decline in the GSE share in forbearance. However, not only the did the share of Ginnie Mae loans in forbearance increase, new requests for forbearance for these loans have increased for two consecutive weeks. While housing market data continue to show a quite strong recovery, the job market recovery appears to have slowed, and we are seeing the impact of this slowdown on FHA and VA borrowers in the Ginnie Mae portfolio.”

–MBA Chief Economist Mike Fratantoni.