The Mortgage Bankers Association, in comments yesterday to the Federal Housing Finance Agency, said the FHFA Strategic Plan for fiscal years 2021-2024 should continue to work toward an ultimate goal: releasing Fannie Mae and Freddie Mac from federal conservatorship—but only when they are able to do so without risk to the real estate finance markets.

Category: News and Trends

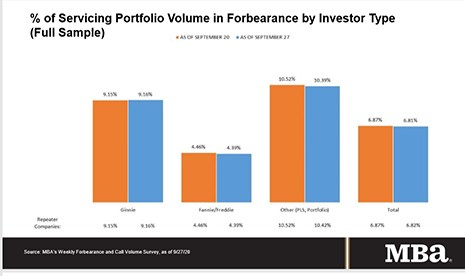

MBA: Share of Loans in Forbearance Falls to 6.81%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.

Quote

“The significant churn in the labor market now, more than six months into the pandemic, is still causing financial distress for millions of homeowners. As a result, more than 70 percent of loans in forbearance are now in an extension.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

CFPB: TRID Rule Results ‘Mixed, But Leans Positive’

The Consumer Financial Protection Bureau released its assessment of the TRID Integrated Disclosure Rule, acknowledging the rule resulted in “sizeable implementation costs” for mortgage lenders and servicers but finding the rule ultimately benefited consumers.

Jessica Longman: Education is Key–Reduce Homeowner Frustration Regarding Property Taxes

Some of the most common questions that servicers receive from customers revolve around property taxes. An important aspect to providing an excellent experience for your customers includes educating them on the critical pieces they need to know about their loan; in turn this will reduce call volume relating to property tax questions and reduce overall homeowner frustration about taxes and payments.

State Financial Regulators Seek Comment on ‘Prudential Standards’ for Nonbank Mortgage Servicers

The Conference of State Bank Supervisors seeks public input on proposed regulatory prudential standards for nonbank mortgage servicers, as the state-regulated industry covers an increasing share of this market.

Life Insurers Brace for Higher Commercial Mortgage Losses

Fitch Ratings, New York, said life insurance companies could see higher losses on commercial mortgage loans than they saw during the Great Recession.

MBA Offers Recommendations to CFPB ‘Seasoned QM’ Proposal

The Mortgage Bankers Association, in an Oct. 1 letter to the Consumer Financial Protection Bureau, offered several recommendations in response to the Bureau’s request for comment on its proposed rule creating a new category of “seasoned” Qualified Mortgage loans.

CoreLogic: Nearly 2 Million Homes at Elevated Risk of Wildfire Damage

CoreLogic, Irvine, Calif., released its 2020 Wildfire Risk Report as smoky skies and poor air quality continue to burden cities up and down the West Coast.

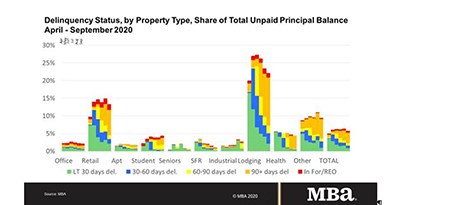

MBA: September Commercial, Multifamily Mortgage Delinquencies Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey reported.