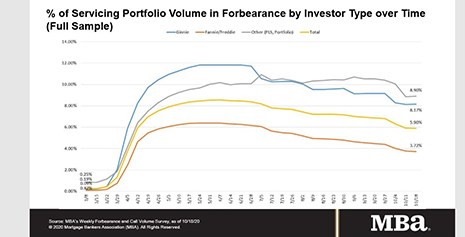

“With more borrowers exiting forbearance in the prior week, the share of loans in forbearance declined across all loan types. Almost half of forbearance exits to date have been from borrowers who remained current while in forbearance, or who were reinstated by paying back past-due amounts.” — MBA Senior Vice President and Chief Economist Mike Fratantoni.

Category: News and Trends

Tom Lamalfa: October 2020 Survey Scorecard

In early October I surveyed 33 senior executives from 33 separate mortgage companies about a wide array of issues and topics both germane and important to the mortgage banking industry. It was the 24th time such a survey was conducted by me since 2008.

MBA: Share of Mortgage Loans in Forbearance Dips Slightly to 5.90%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 5.90% of servicers’ portfolio volume as of Oct. 18, from 5.92% the prior week. MBA estimates 3 million homeowners are in forbearance plans.

Christy Moss, CMB, and Ken Logan, CMB: Reps and Warrants Relief Key to IMB Liquidity Strategies

For independent mortgage banks, the name of the game is liquidity. Lenders with an eye and a taste for transformative growth are equally attentive to their liquidity strategies, including how their origination practices impact liquidity now and after the current cycle ends.

‘Ghosting’ and ‘Not OK? That’s OK:’ Servicing During a Pandemic

The COVID-19 pandemic has hit borrowers hard. But mortgage servicers are eager to help.

GSE Executives Discuss Pandemic Response, Defend New Refinance Fee

The government-sponsored enterprises have supported and provided critical liquidity to the market throughout the COVID-19 pandemic, Fannie Mae and Freddie Mac executives said.

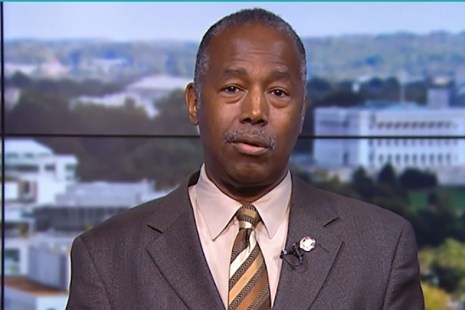

Carson: FHA Will Extend Forbearance Requests Through Year-End

HUD Secretary Ben Carson announced the Federal Housing Administration will extend the date for single-family homeowners with FHA-insured mortgages to request an initial forbearance from their mortgage servicer for up to six months.

CFPB Extends GSE Patch ‘Indefinitely;’ Kraninger Stresses Flexibility

In a wide-ranging discussion during the Mortgage Bankers Association’s virtual Annual Convention & Expo, Consumer Financial Protection Bureau Direcgor Kathy Kraninger told MBA Chair Susan Stewart that the Bureau would continue to move forward with its agenda of easing regulatory burdens and providing mortgage lenders and servicers with greater flexibilities in working with customers.

MBA Forecast: 2020 Best Year For Industry Since 2003; 2021 Purchase Originations to Increase to Record $1.54 Trillion

In its latest forecast, the Mortgage Bankers Association said purchase originations are expected to grow by 8.5% to a record $1.54 trillion in 2021. And after a substantial 70.9% jump in activity in 2020, MBA anticipates refinance originations to slow next year, decreasing by 46.3% to $946 billion.

Quote

“We hope you’ll join us and try to create an ‘echo chamber’ of help. So customers will know that if they need help they can get help and they won’t need to bring money to the table. They can raise their hand and we’ll pull out all the tools that are available to them. We’re hoping this will reach a hard-to-reach audience.”

–Dana Dillard, Executive Vice President of Corporate and Social Responsibility with Mr. Cooper, Dallas.