The coronavirus has caused a sea change in Americans’ attitudes toward home. With millions now working from home—many permanently—they are rethinking everything: how to repurpose rooms; how many cars they need to own; and especially, where they want to live, not where they need to live.

Category: News and Trends

Commercial, Multifamily Borrowing Falls 47% in Third Quarter

Commercial and multifamily mortgage loan originations were 47 percent lower in the third quarter compared to a year ago, and increased 12 percent from the second quarter of 2020, the Mortgage Bankers Association reported.

MISMO Seeks Comment on New API Toolkit

MISMO, the mortgage industry’s standards organization, released its new MISMO API (application programming interface) Toolkit yesterday for a 60-day member comment period.

Share of Mortgage Loans in Forbearance Decreases to 5.83%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey revealed the total number of loans now in forbearance decreased by 7 basis points from 5.90% of servicers’ portfolio volume in the prior week to 5.83% as of October 25, 2020.

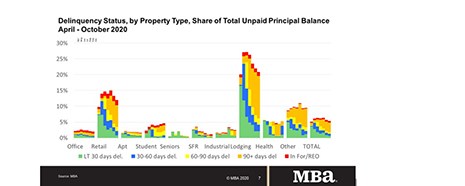

Commercial, Multifamily Delinquencies Decline in October

Delinquency rates for mortgages backed by commercial and multifamily properties declined in October, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

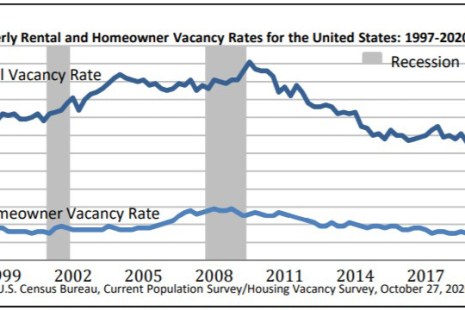

3Q Homeownership Rate Falls by 0.5%

Despite a jump in home purchase activity this summer—but also perhaps because of the coronavirus pandemic—the U.S. homeownership rate slipped by 0.5 percent in the third quarter, the Census Bureau reported Thursday.

Federal Agencies Propose Regulation Codifying Use of Supervisory Guidance

Five federal agencies last week issued a proposed regulation that would codify a 2018 guidance clarifying that supervisory guidance does not have “force and effect of law.”

Tom Lamalfa: October 2020 Survey Scorecard

In early October I surveyed 33 senior executives from 33 separate mortgage companies about a wide array of issues and topics both germane and important to the mortgage banking industry. It was the 24th time such a survey was conducted by me since 2008.

ATTOM: ‘Zombie’ Properties Diminish Amid Foreclosure Moratorium

ATTOM Data Solutions, Irvine, Calif., reported 200,065 properties in the process of foreclosure in the fourth quarter, down by 7.3 percent from the third quarter. Of those, then number sitting empty—also known as “zombie” foreclosures, fell by 4.4 percent to 7,612.

CoreLogic Reports 26.3% Decrease in Mortgage Fraud Risk

CoreLogic, Irvine, Calif., reported a 26.3% year-over-year decrease in fraud risk at the end of the second quarter, the second year of substantial decreases in risk.