The Federal Housing Finance Agency on Nov. 18 released a final rule that establishes a new regulatory capital framework for Fannie Mae and Freddie Mac.

Category: News and Trends

FHFA Sets $70 Billion 2021 GSE Multifamily Loan Purchase Caps

The Federal Housing Finance Agency last week announced 2021 multifamily loan purchase caps for Fannie Mae and Freddie Mac at $70 billion for each Enterprise, totaling $140 billion in support to the multifamily market.

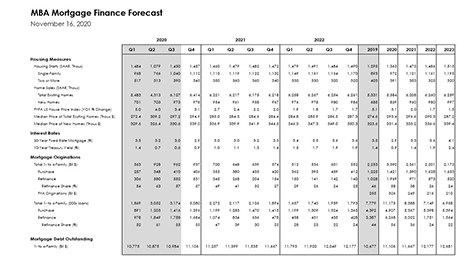

MBA: Upward Revisions to 2020, 2021 Mortgage Forecasts

The most volatile and unpredictable economy in a decade has produced the strongest housing market in more than a decade—and, according to the Mortgage Bankers Association, it could get even stronger.

Ratings Agency Seeks Better CRE Lending Disclosures

Better disclosures would allow rating agencies to better assess commercial real estate credit risk in bank loan portfolios, said DBRS Morningstar, Toronto.

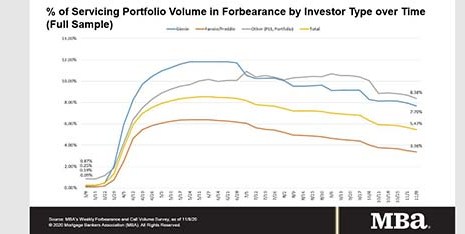

MBA: Share of Mortgage Loans in Forbearance Falls to 5.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

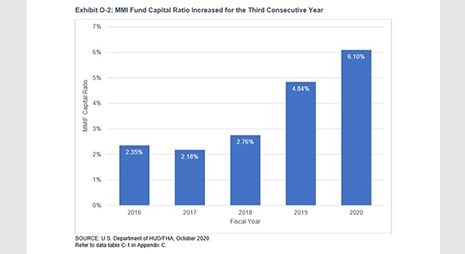

FHA 2020 Actuarial Report: MMI Fund Capital Ratio at 13-Year High

The Federal Housing Administration om Friday said its Mutual Mortgage Insurance Fund capital ratio ended fiscal year 2020 at 6.1 percent, well above its congressionally mandated 2.0 percent capital ratio to its highest level since 2007.

FHA Proposes Private Flood Insurance Option for Single-Family Mortgages

The Federal Housing Administration last week published a proposed rule to allow a private flood insurance option, instead of insurance through the National Flood Insurance Program, when flood insurance is required by FHA.

‘Not Ok? That’s Ok:’ Financial Services, Consumer Coalition Launches Borrower Awareness Campaign

The Mortgage Bankers Association and a broad coalition of financial services stakeholders – including mortgage servicers, trade associations, housing counseling agencies, governmental agencies and think tanks – launched a consumer awareness campaign to reach borrowers who have missed one or more mortgage payments as a result of the COVID-19 pandemic and may be eligible for forbearance assistance under the CARES Act or other forms of mortgage payment relief.

MBA, Trade Groups Ask Banking Agencies for TDR Relief

The Mortgage Bankers Association and more than a half-dozen industry trade groups asked federal banking agencies for guidance that loan modifications with terms longer than six months fall within the troubled debt restructuring relief provided by a recent Interagency Statement on Loan Modifications and Reporting for Financial Institutions Working with Customers Affected by the Coronavirus.

Quote

“With forbearance plans still active and foreclosure moratoriums in place until at least the end of the year, many borrowers experiencing longer-term distress will remain in this delinquency category until a loss mitigation resolution is available.”

–MBA Vice President of Industry Analysis Marina Walsh, CMB.