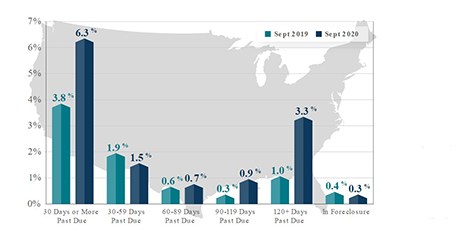

CoreLogic, Irvine, Calif., said its monthly Loan Performance Insights Report for September showed a leveling off of serious loan delinquencies, a “positive signal” that the housing finance industry is thus far adjusting to the pandemic-induced economic downturn.

Category: News and Trends

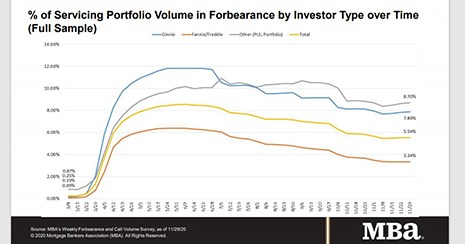

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

REIT Outlook Negative, But Improving

The 2021 rating outlook for U.S. real estate investment trusts remains negative, but Fitch Ratings, New York, said its outlook for the sector is improving.

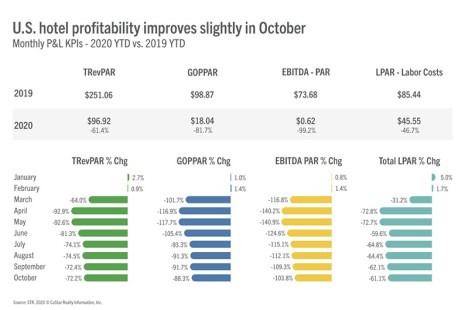

Hotel Sector Recovery Slows

The hotel sector recovery has slowed in recent months after rebounding in the fall from April lows, said Fitch Ratings, New York.

FHA Follows Suit, Raises Single-Family Loan Limits for 2021

As expected, the Federal Housing Administration matched Fannie Mae and Freddie Mac in its single-family and Home Equity Conversion Mortgage insurance programs for 2021.

FHFA Extends Foreclosure and REO Eviction Moratoria through Jan. 31

The Federal Housing Finance Agency said Fannie Mae and Freddie Mac will extend the moratoriums on single-family foreclosures and real estate owned (REO) evictions until at least January 31, 2021.

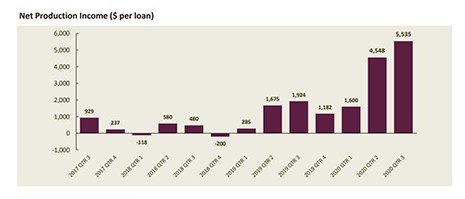

MBA: 3Q Mortgage Production Volume Spurs Strong IMB Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $5,535 on each loan they originated in the third quarter, up from $4,548 per loan in the second quarter, the Mortgage Bankers Association reported Thursday in its Quarterly Mortgage Bankers Performance Report.

Dave Parker: Rebounding Non-QM Market Requires Quality Review to Mitigate Risk

The non-QM market is making a recovery and, with continued demand from borrowers, changes to the current QM lending rule and the approaching expiration of the QM patch, is likely to stay on the rebound. As a new range of products come to the market, the question now becomes, how can the mortgage industry ramp up and ensure loan quality for lenders, servicers and investors?

Quote

“With the surge in mortgage production volume in the third quarter, net production profits among independent mortgage bankers increased, surpassing 200 basis points for the first time since the inception of MBA’s report in 2008. Soaring production revenues – led by strong secondary marketing gains – drove these results and more than offset an increase in production expenses.”

–MBA Vice President of Industry Analysis Marina Walsh, CMB.

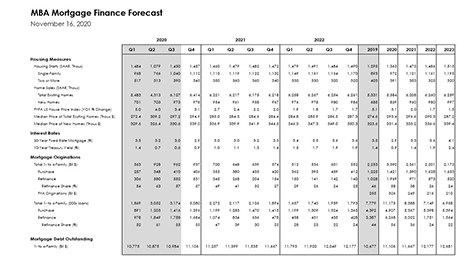

MBA: Upward Revisions to 2020, 2021 Mortgage Forecasts

The most volatile and unpredictable economy in a decade has produced the strongest housing market in more than a decade—and, according to the Mortgage Bankers Association, it could get even stronger.