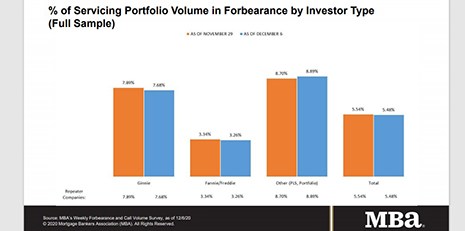

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

Category: News and Trends

Quote

“MBA applauds the Bureau for releasing the final General and Seasoned QM rules. The revisions to these rules will preserve and expand responsible access to affordable credit while retaining core consumer protections. In particular, these rules remove cumbersome requirements for non-traditional sources of income and expand consumers’ choices. MBA appreciates the Bureau’s effort to seek stakeholder input, and we look forward to continuing to work together on other issues aimed at protecting consumers.”

–MBA President & CEO Robert Broeksmit, CMB.

Scott Colclough: Amidst Uncertainty, Hedging Still Works

By maintaining a prudent hedging strategy constructed using mortgage-backed securities, mortgage lenders can match market movement on the value of borrower locks to the market in which the locks were taken.

Andrew Foster: Top Five Commercial Mortgage Servicing Issues to Watch in 2021

While most will be monitoring increased infections and the progress of vaccine distribution and effectiveness, loan servicing and asset management professionals will have some additional factors impacting their organizations and books of business in the new year.

CFPB Issues Final Mortgage Rules on General QM, Seasoned QM

The Consumer Financial Protection Bureau on Thursday issued final rules related to qualified mortgage loans. The Mortgage Bankers Association provided preliminary summaries of the final rules.

The Redesigned URLA Is Coming Jan. 1. Are You Ready?

Fannie Mae and Freddie Mac (the GSEs) will ring in the New Year by starting to accept the redesigned Uniform Residential Loan Application (URLA) and updated automated underwriting system (AUS) loan application submission files based on MISMO v3.4. Beginning January 1, 2021, all lenders, aggregators and third-party originators who are ready to send and accept the redesigned URLA may participate in the two-month Open Production Period (OPP), which allows for a gradual transition prior to the March 1, 2021 mandate.

ATTOM: Fewer Foreclosure Filings as Moratoria Extend into 2021

ATTOM Data Solutions, Irvine, Calif., said foreclosure filings continued to fall last month amid the budding holiday season and federal and state foreclosure moratoria.

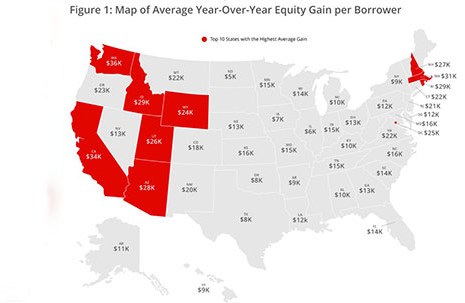

Home Equity Reaches Record High: Homeowners Gained $1 Trillion in 3Q Equity

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages saw their equity increase by 10.8% year over year in the third quarter—a collective equity gain of $1 trillion and an average gain of $17,000 per homeowner.

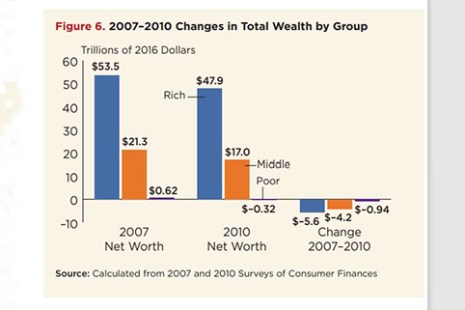

RIHA Study: Widening Inequality After Great Recession Attributed to Decline in Homeownership, Home Values

Distribution of wealth among U.S. households became increasingly unequal from 2007 through 2016 as a decline in homeownership and home values impacted the wealth of middle-class families, according to a new research report, The Distribution of Wealth Since the Great Recession, released last week by the Mortgage Bankers Association’s Research Institute for Housing America.

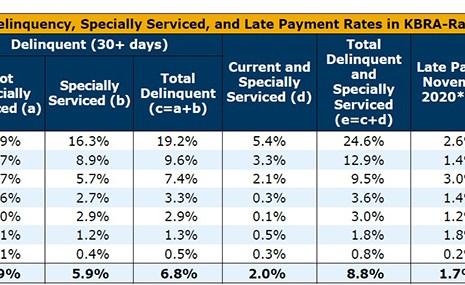

CMBS Delinquency Rate Dips

The commercial mortgage-backed securities delinquency rate dipped in November, largely due to continued Coronavirus debt relief, said Fitch Ratings, New York.