David Upbin is Vice President of Education Operations and Programming & MBA Strategy with the Mortgage Bankers Association. He joined MBA in 2013 and is responsible for financial management, operations, delivery and programming of MBA Education’s suite of training products and events.

Category: News and Trends

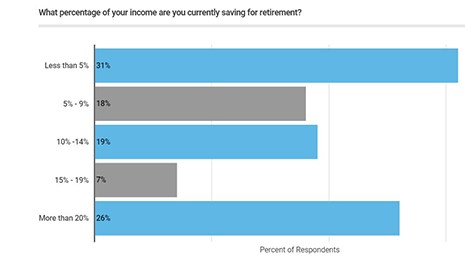

Most Americans Falling Behind on Retirement Planning

A report from Clever Real Estate, St. Louis, shows the majority of Americans are not saving enough money for their retirement—and retirees are living beyond their means.

2020 Foreclosure Activity at 16-Year Low

ATTOM Data Solutions, Irvine, Calif., said U.S. foreclosure filings fell to just over 200,000 in 2020, the lowest level since it began tracking such data in 2005.

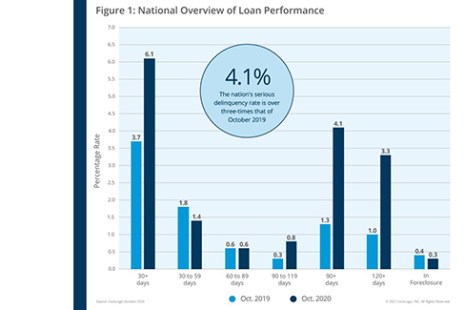

CoreLogic: Mortgage Delinquencies Rise, But Pace Moderates

CoreLogic, Irvine, Calif., said on a national level, 6.1% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in October, a 2.4-percentage point increase from a year ago, when it was 3.7%.

Pandemic Year Brings Huge Surge in ‘Million-Dollar Cities’

Move over, San Francisco Bay Area and New York City; you’ve got company—lots of it.

Quote

“[Thursday’s] announcement preserves and extends a level playing field for lenders of all sizes and business models while avoiding near-term measures that could have threatened market stability. MBA has cautioned that a premature release of the GSEs from conservatorship could roil the mortgage market, hurting borrowers, savers and investors and harming a fragile economy still recovering from the ravages of the pandemic.”

–MBA President & CEO Robert Broeksmit, CMB

Michael Steer: A New Year, A New Regulatory Attitude?

Lenders can adapt the current pandemic regulatory attitude into one that pays equal mind to both the pandemic and the importance of compliance.

David Olson and Kimberly Browne of Chrysalis Holdings LLC on Mortgage Capital Markets

MBA NewsLink posed questions to David Olson, Chairman of Chrysalis Holdings LLC, Washington, D.C., and Kimberly Browne, the company’s President.

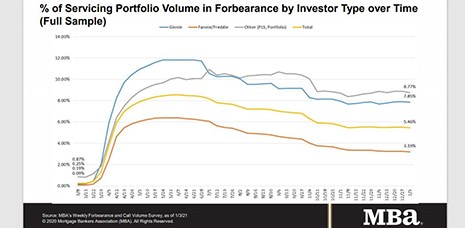

MBA: Share of Loans in Forbearance Drops to 5.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.46% of servicers’ portfolio volume as of Jan. 3 compared to 5.46% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

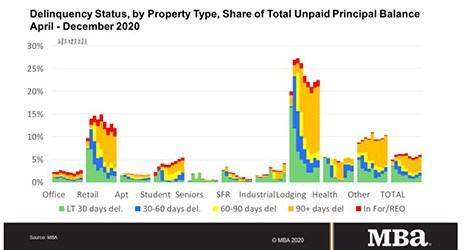

MBA: December Commercial/Multifamily Mortgage Delinquencies Rise

Delinquency rates for mortgages backed by commercial and multifamily properties Increased for the second month in a row in December, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.