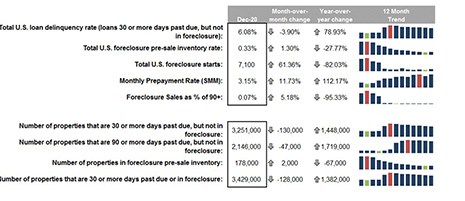

Black Knight, Jacksonville, Fla., said 2020 ended with 1.54 million more delinquent and 1.7 million more seriously delinquent mortgages than at the start of the year, a looming reminder of the challenges facing the market in 2021.

Category: News and Trends

HUD Extends FHA Foreclosure/Eviction Moratorium through Mar. 31

HUD on Jan. 21 extended the moratorium on FHA single-family foreclosures and evictions through Mar. 31.

Kraninger Steps Down as CFPB Director

Consumer Financial Protection Bureau Director Kathy Kraninger announced her resignation on Jan. 20, paving the way for President Joe Biden’s nominee, Rohit Chopra, to take over the agency.

FHA to Permit DACA-Status Recipients to Apply for FHA-Insured Mortgages

HUD said Jan. 20 it will permit individuals classified under the “Deferred Action for Childhood Arrivals” program (DACA) with the U.S. Citizenship & Immigration Service and are legally permitted to work in the U.S. to apply for mortgages backed by FHA.

CFPB Issues Final Rules Clarifying Role of Supervisory Guidance, Escrow Accounts

In final actions of the Trump Administration, the Consumer Financial Protection Bureau yesterday issued two final rules. The first confirms the Bureau’s use of supervisory guidance for its supervised institutions; the second exempts certain financial institutions from establishing escrow accounts for higher-priced mortgage loans.

Quote

“The term ‘lawful residency’ pre-dates DACA and thus did not anticipate a situation in which a borrower might not have entered the country legally, but nevertheless be considered lawfully present. To avoid confusion and provide needed clarity to HUD’s lending partners, FHA is waiving the above referenced FHA Handbook subsection in its entirety. In a subsequent update to the FHA Handbook the language will be removed.”

–From a HUD announcement clarifying FHA loan eligibility for DACA participants.

MBA Letter Offers Support for Yellen Treasury Nomination

Janet Yellen, President-Elect Joseph Biden Jr.’s nominee for Treasury Secretary, appears this morning for a confirmation hearing before the Senate Finance Committee. Ahead of the hearing, the Mortgage Bankers Association sent a letter in support of her nomination.

Biden Nominates Rohit Chopra to Lead CFPB

President-Elect Joe Biden on Monday nominated Rohit Chopra, who worked closely with Elizabeth Warren in creating the Consumer Financial Protection Bureau in the wake of the Great Recession, to serve as the Bureau’s next Director.

Insurance Quotes and Coverages: Hardening Insurance Market and Lender Implications

MBA Newslink interviewed Servicer Council Vice Chair Laura Smith and Nick Yuhas, who recently co-authored a white paper with other members of the Insurance Regulatory Group on the Hardening Insurance Market.

FHFA Amends GSE Stock Purchase Agreements; Leaves Decision on Conservatorship to Biden Administration

Fannie Mae and Freddie Mac will not exit federal conservatorship under the Trump Administration; the Federal Housing Finance Agency will leave that decision to the Biden Administration, FHFA said Thursday.