Ginnie Mae reached a milestone in its Digital Collateral Program this month with issuance of the first mortgage-backed security backed by Digital Pools, consisting entirely and exclusively of eNotes.

Category: News and Trends

Home Seller Profits Soar to Highest Rates Since 2005

ATTOM Data Solutions, Irvine, Calif., said home sellers nationwide in 2020 realized a home-price gain of $68,843 on the typical sale, up from $53,700 in 2019 and $48,500 two years ago.

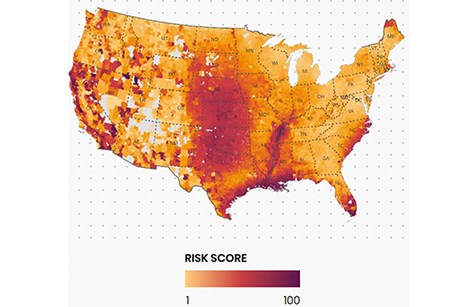

CoreLogic: Catastrophes Illustrate Impact of Climate Change on Housing

When you include the word “catastrophe” in the headline of a report, it tends to get attention. And CoreLogic, Irvine, Calif., says “catastrophe” plays an ominous role in the present and future housing environments.

Stacey Berger of Midland Loan Services on Servicing Technology

MBA NewsLink recently interviewed Stacey M. Berger, Executive Vice President of Midland Loan Services, Overland Park, Kan.

Quote

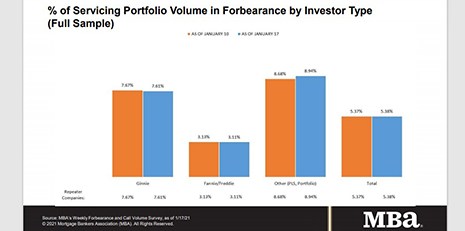

“While new forbearance requests dropped slightly, the rate of exits from forbearance was at the slowest pace since MBA began tracking exit data last summer. Overall, the forbearance numbers have been little changed over the past few months. Homeowners still in forbearance are likely facing ongoing challenges with lost jobs, lost income and other impacts from the pandemic.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

TransUnion: Percentage of Consumers with Financial Accommodations Remains Elevated

TransUnion, Chicago, said its latest Financial Services Monthly Industry Snapshot Report shows 2.87% of accounts in the auto, credit card, mortgage or unsecured personal loan industries remained in some form of financial hardship status at the end of December.

MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased slightly to 5.38% of servicers’ portfolio volume as of Jan. 17 from 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

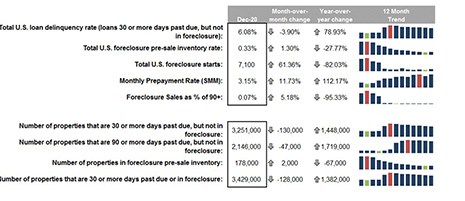

Black Knight First Look: 2020 Ends with Higher Delinquencies, Lower Foreclosures

Black Knight, Jacksonville, Fla., said 2020 ended with 1.54 million more delinquent and 1.7 million more seriously delinquent mortgages than at the start of the year, a looming reminder of the challenges facing the market in 2021.

HUD Extends FHA Foreclosure/Eviction Moratorium through Mar. 31

HUD on Jan. 21 extended the moratorium on FHA single-family foreclosures and evictions through Mar. 31.

Kraninger Steps Down as CFPB Director

Consumer Financial Protection Bureau Director Kathy Kraninger announced her resignation on Jan. 20, paving the way for President Joe Biden’s nominee, Rohit Chopra, to take over the agency.